NO.PZ2021061002000051

问题如下:

Which of the following statements is true

about FRA and interest rate futures?

选项:

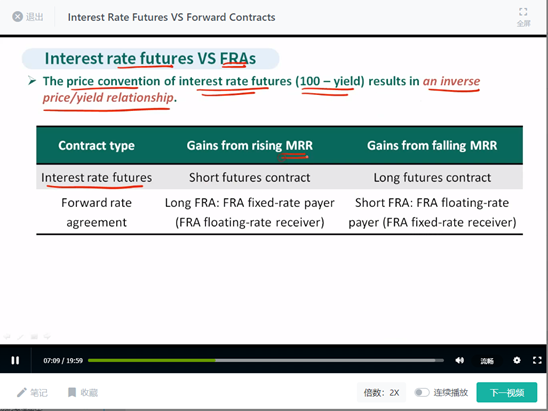

A.Both a long FRA position and a long interest

rate futures position benefit form interest rate rising.

To hedge against a decrease in interest rates,

investors could enter a long FRA position.

A short interest rate futures position

benefit from rising interest rates.

解释:

中文解析

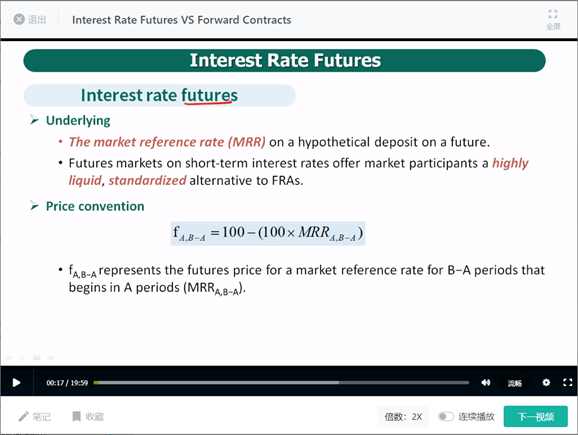

A选项: long FRA,即支付固定的利率,收到的是浮动利率,因此会在利率上升的时候获利;但是long interest rate futures是在利率下跌的时候获利。A错。

B选项,为了对冲利率下跌带来的风险,应该进入的是在利率下跌的时候可以获利的头寸,因此应该进入short FRA的头寸。

C选项,期货合约的价格和利率是反向关系,因此short interest rate futures在利率上升的时候获利,正确。

按照C的逻辑,反向关系,那么利率上升,价格下降,short 没有benefit 啊