NO.PZ2018123101000049

问题如下:

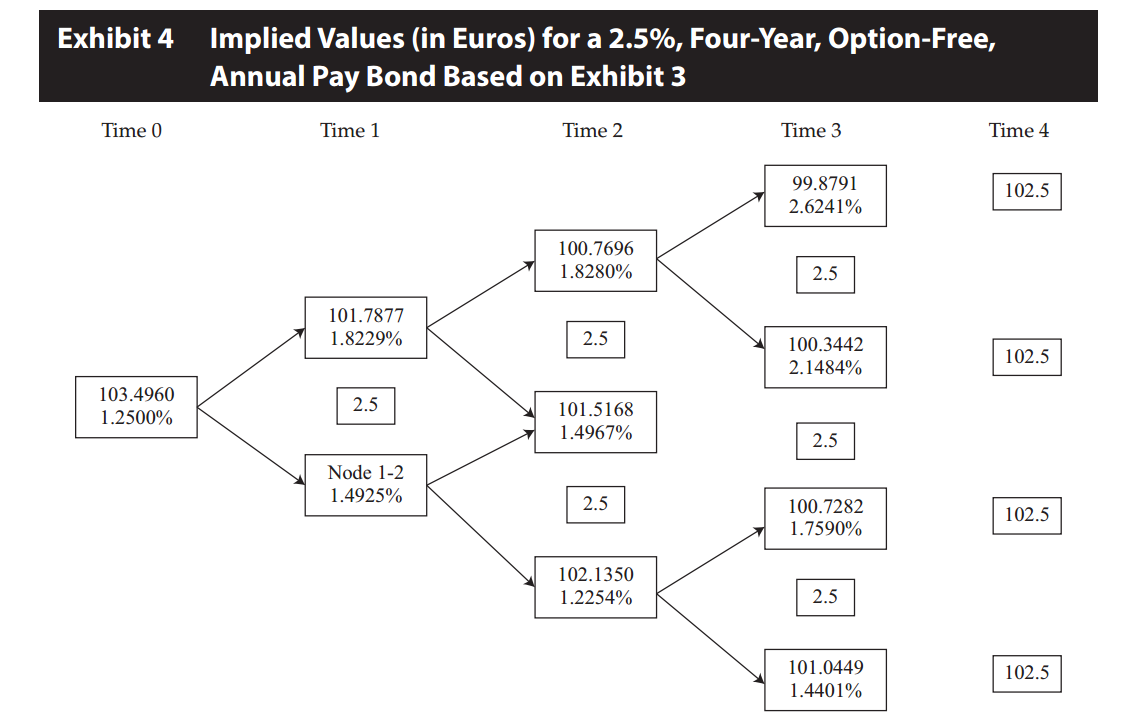

Exhibit 3 presents most of the data of a binomial lognormal interest rate tree. Exhibit 4 presents most of the data of the implied values for a four-year, option-free, annual pay bond with a 2.5% coupon based on the information in Exhibit 3.

Based on the information in Exhibits 3 and 4, the bond price in euros at Node 1–2 in Exhibit 4 is to:

Based on the information in Exhibits 3 and 4, the bond price in euros at Node 1–2 in Exhibit 4 is to:

选项:

A.

102.7917

B.

104.8640

C.

105.2917

解释:

A is correct.

考点:考察利用利率二叉树定价

解析: 想要得到节点1-2的债券价值,用到的数据有:该节点右边的数据,即节点2-2,节点2-3的债券价值和Coupon,以及第一年末至第二年的Forward rate。通过对未来债券价值的折现求得该节点1-2的债券价值:

value = {2.5+(0.5×101.5168+0.5×102.1350)} / 1.014925 = 102.7917

能否用t0和t1的数据推出答案?只能从后往前推么