NO.PZ2016031001000026

问题如下:

Which of the following bond types provides the most benefit to a bondholder when bond prices are declining?

选项:

A.Callable

B.Plain vanilla

C.Multiple put

解释:

C is correct.

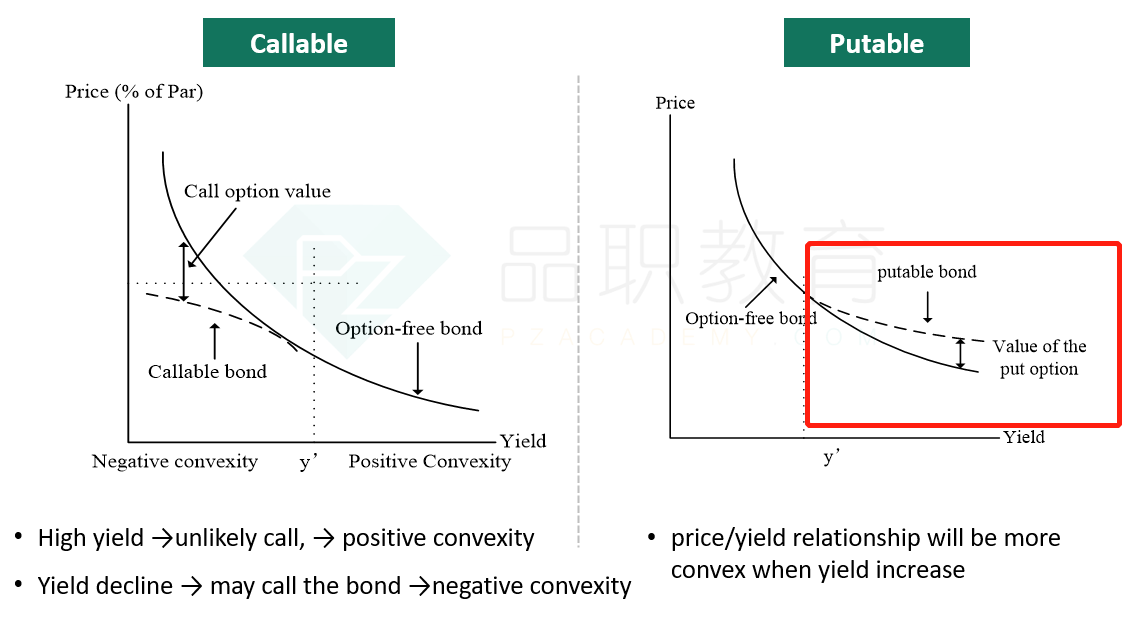

A putable bond is beneficial for the bondholder by guaranteeing a prespecified selling price at the redemption date, thus offering protection when interest rates rise and bond prices decline. Relative to a one-time put bond that incorporates a single sellback opportunity, a multiple put bond offers more frequent sell back opportunities, thus providing the most benefit to bondholders.

考点:含权债券

解析:callable bond,即可赎回债券。当利率下降的时候,callable bond会被债券发行人提前以call price赎回,所以callable bond的价格涨不上去,会有一个上限。callable bond是对发行人有利的,而不是对债券持有人(bondholder)有利的。故A选项不正确。

plain vanilla bond,即固定利率债券,期间支付固定的票息,到期归还本金。当债券价格下降,即利率上升的时候,价格就正常跌下去了,不会对bondholder有利。故B选项不正确。

putable bond,即可回售债券。当利率上升的时候,putable bond的债券持有人以提前约定好的put price回售给发行人,所以putable bond的价格跌不下去,会有一个价格下限。putable bond在债券价格下降的时候对债券持有人有利。故C选项正确。

when bond prices are declining,这句话理解成了价格下降,利率你上升?是我翻译错了吗