NO.PZ2022061307000084

问题如下:

QuestionPar value per share: $10

Annual dividend per share: $2

Maturity: 15 years

An investor’s required rate of return is 8%, and the current market price per share of the preferred stock is $25. By comparing the estimated intrinsic value with the market price of the preferred stock, the most likely conclusion is that the preferred stock is:

A company has issued non-callable, non-convertible preferred stock with the following features:选项:

A.fairly valued at $25.00. B.overvalued by $4.73. C.undervalued by $15.00.解释:

SolutionB is correct. Using a financial calculator to find the present value (PV) of the future cash flows, intrinsic value is thus: FV = $10; n = 15; PMT = $2; r = 8%. Compute PV = $20.27.

The preferred stock is overvalued by $4.73 (Market price of $25 – Estimated value of $20.27).

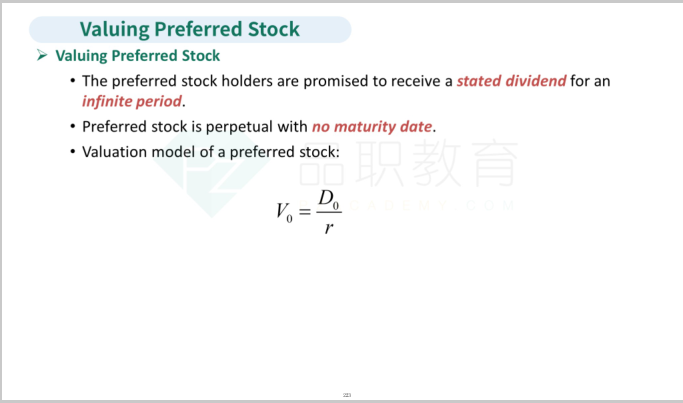

A is incorrect. It ignores the maturity information and treats it as a perpetual preferred stock.

V0 = D0/r = $2/0.08 = $25

C is incorrect. It ignores the time value of money and simply sums up the total of dividends and the par value.

V0 = (Annual dividend per share × Maturity) + Par Value = (2 × 15) + 10

= 40

Thus, the preferred stock appears to be undervalued by $15.00 (Market price of $25 – Estimated value of $40).

所以在这里计算优先股的市场价格是将优先股视作了固定收益债券?