NO.PZ2019100901000014

问题如下:

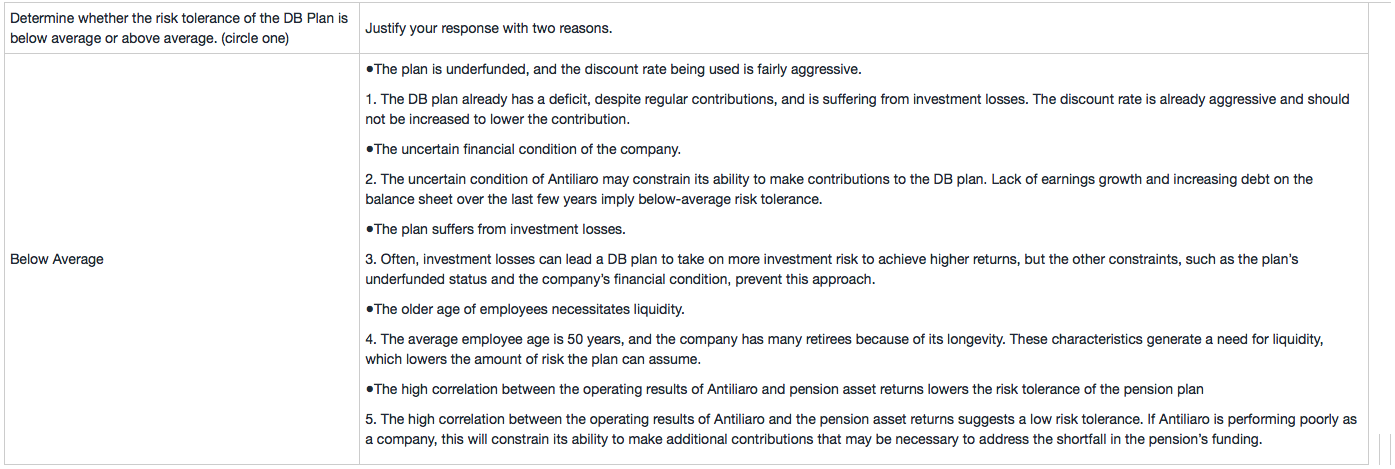

Dianna Mark is the chief financial officer of Antiliaro, a relatively mature textile production company headquartered in Italy. All of its revenues come from Europe, but the company is losing sales to its Asian competitors. Earnings have been steady but not growing, and the balance sheet has taken on more debt in the past few years in order to maintain liquidity. Mark reviews the following facts concerning the company’s defined benefit (DB) pension plan:

●The DB plan currently has €1 billion in assets and is underfunded by €100 million in relation to the projected benefit obligation (PBO) because of investment losses.

●The company to date has made regular contributions.

●The average employee age is 50 years, and the company has many retirees owing to its longevity.

●The duration of the plan’s liabilities (which are all Europe based) is 10 years.

●The discount rate applied to these liabilities is 6%.

●There is a high correlation between the operating results of Antiliaro and pension asset returns.

Determine whether the risk tolerance of the DB plan is below average or above average. Justify your response with two reasons.

选项:

解释:

the DB plan is below average

关于这道题可以答的点很多,都能证明是below average

the risk tolerance of the DB plan is below average.

because the earning of company has not grown with less strong finance.

the DB pension plan is underfunded due to investment losses, which brings lower risk tolerance.

the average employee age is 50 years, the pension asset need enough liquidity to meet future benefit payment, which makes a lower risk tolerance.

the other, a high correlation between the operating results of Antiliaro and pension asset returns makes risk tolerance below average.

这样答可以不?