NO.PZ2018120301000001

问题如下:

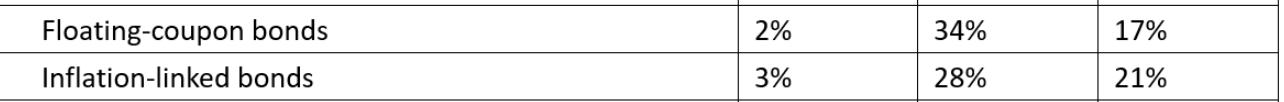

Cécile

is a junior analyst for an international wealth management firm. Her

supervisor, Margit, asks Cécile to evaluate three fixed-income funds as part of

the firm’s global fixed-income offerings. Selected financial data for the funds

Aschel, Permot, and Rosaiso are presented in Exhibit 1. In Cécile’s

initial review, she assumes that there is no reinvestment income and that the

yield curve remains unchanged.

Based on Exhibit 1, which fund provides the highest level of protection against inflation for coupon payments?

选项:

A.Aschel

Permot

Rosaiso

解释:

Correct Answer: B

B is correct. Permot has the highest percentage of floating-coupon bonds and inflation-linked bonds. Bonds with floating coupons protect interest income from inflation because the reference rate should adjust for inflation. Inflation-linked bonds protect against inflation by paying a return that is directly linked to an index of consumer prices and adjusting the principal for inflation. Inflation-linked bonds protect both coupon and principal payments against inflation.

The level of inflation protection for coupons equals the percentage of the portfolio in floating-coupon bonds plus the percentage of the portfolio in inflation-linked bonds:

Aschel = 2% + 3% = 5%.

Permot = 34% + 28% = 62%.

Rosaiso = 17% + 21% = 38%.

Thus, Permot has the highest level of inflation protection, with 62% of its portfolio in floating-coupon and inflation-linked bonds.

既然问的是protection against inflation for coupon payments,我理解是只关注COUPON PAYMENT就可以了。为啥不直接比较34%和17%就可以了。还要比34+28,17+21。