Morrison has been working on executing a sell order to liquidate shares in Acme Industrials (ACME). The closing price on Tuesday was $79.90. Morrison received the order from Wright before the market open on Wednesday morning to sell 50,000 ACME shares with a day limit of $80.00. No part of the order is filled on Wednesday, and the stock closes the day at $79.60. On Thursday morning, Morrison instructed a new day order to sell the 50,000 shares at $79.50; 30,000 shares were sold at $79.50 per share, with resulting commissions and fees for the trade of $0.02 per share. Shares for ACME closed the day Thursday at a price of $79.40 per share. No further attempts were made to sell the unfilled 20,000 shares, which were canceled.

请老师帮忙看下我的算法是否正确:

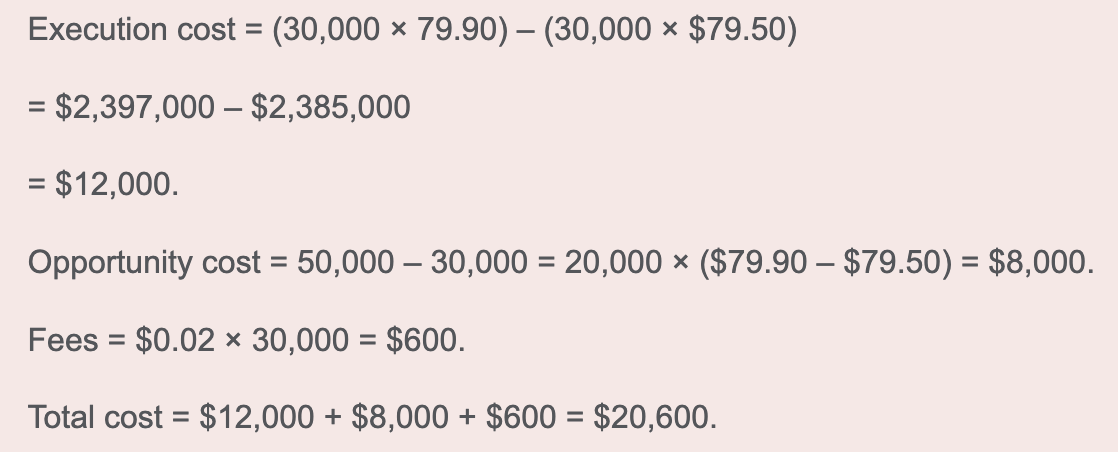

Execution cost = (30,000 × 79.90) – (30,000 × $79.50)

= $2,397,000 – $2,385,000

= $12,000.

Opportunity cost =20,000 × ($79.90 – $79.40) = $10,000.

Fees = $0.02 × 30,000 = $600.

Total cost = $12,000 + $10,000 + $600 = $22,600.

但协会公布的答案是这个,我不太理解: