No.PZ2016082402000054 (选择题)

来源:

A portfolio consists of two zero-coupon bonds, each with a current value of $10. The first bond has a modified duration of one year and the second has a modified duration of nine years. The yield curve is flat, and all yields are 5%. Assume all moves of the yield curve are parallel shifts. Given that the daily volatility of the yield is 1%, which of the following is the best estimate of the portfolio’s daily value at risk (VAR) at the 95% confidence level?

这个题目给的答案是:

VaR= Z*Sigma*Value*Duration=1.65*1%*(10*1+10*9)=1.65

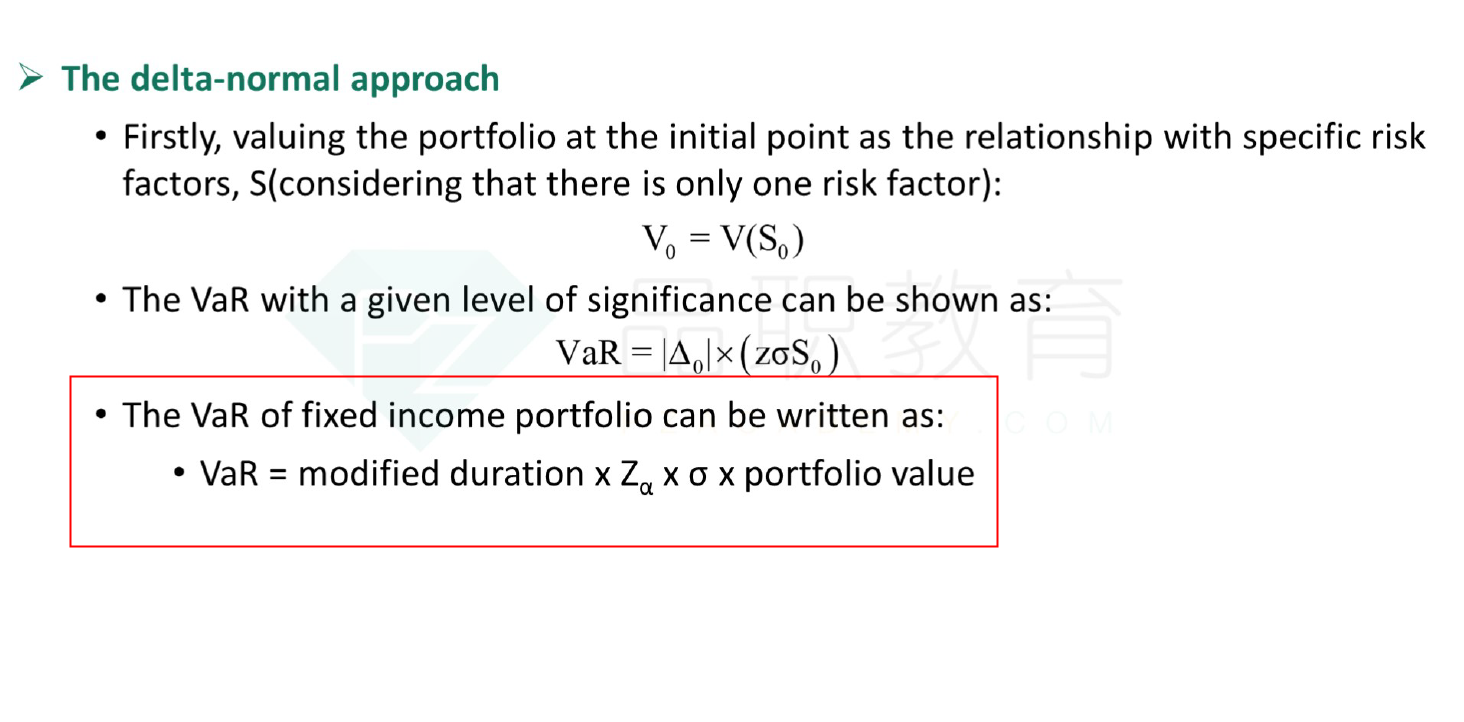

我不是很明白为什么要计算Duration进去。

Var的公式不就是z*sigma*value吗?请老师帮忙解答一下,谢谢。