NO.PZ2019010402000022

问题如下:

Based on the following information, the value of the European-style interest rate call option is:

Assume the notional amount of the option is $1,000,000, the exercise rate is 2.6% and the RN probability is 50%.

选项:

A.2,368

B.2,529

C.3,675

解释:

B is correct.

考点:interest rate option估值

解析:

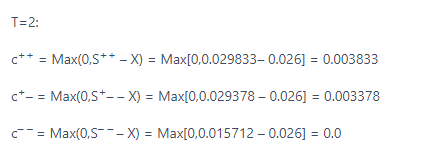

T=2:

c++ = Max(0,S++ – X) = Max[0,0.029833– 0.026] = 0.003833

c+– = Max(0,S+– – X) = Max[0,0.029378 – 0.026] = 0.003378

c– – = Max(0,S– – – X) = Max[0,0.015712 – 0.026] = 0.0

T=1:

T=0:

因为NP=1,000,000,所以call value=0.002529×1,000,000=2,529.17

在计算interest rate option value的时候,一定要特别注意折现率的选取。

请问这个call或者put行权与否怎么判断的?