NO.PZ201809170400000207

问题如下:

In preparation for receipt of the performance bonus, Tong should immediately:

选项:

A.buy two US E-mini equity futures contracts.

B.sell nine US E-mini equity futures contracts.

C.buy seven US E-mini equity futures contracts.

解释:

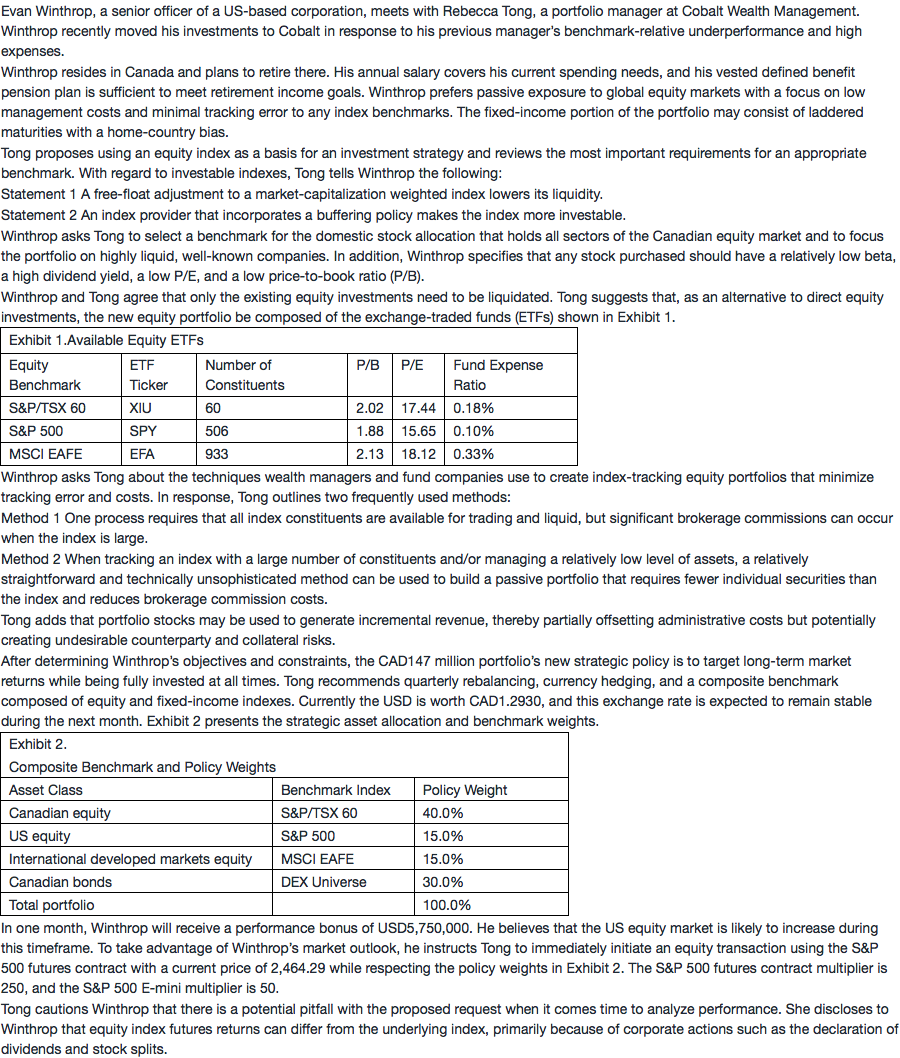

C is correct. The amount of the performance bonus that will be received in one month (USD5,750,000) needs to be invested passively based upon the strategic allocation recommended by Tong. Using the strategic allocation of the portfolio, 15% (USD862,500.00) should be allocated to US equity exposure using the S&P 500 E-mini contract, which trades in US dollars. Because the futures price is 2,464.29 and the S&P 500 E-mini multiplier is 50, the contract unit value is USD123,214.50 (2,464.29 × 50).

The correct number of futures contracts is (5,750,000.00 × 0.15)/123,214.50 = 7.00.

Therefore, Tong will buy seven S&P 500 E-mini futures contracts.

奖金的所有数额不能用来买E-mini 的futures contract吗?

为什么要用奖金*15% 去投资E-MINI 的futures contracts呢?