NO.PZ2020042003000007

问题如下:

Which of the following statement about Funding

Liquidity Risk Measurement is not correct?

选项:

A.The credit spread between Eurodollar LIBOR and Treasuries is known as the TED spread. This reflects expected credit losses as well as a liquidity risk premium.

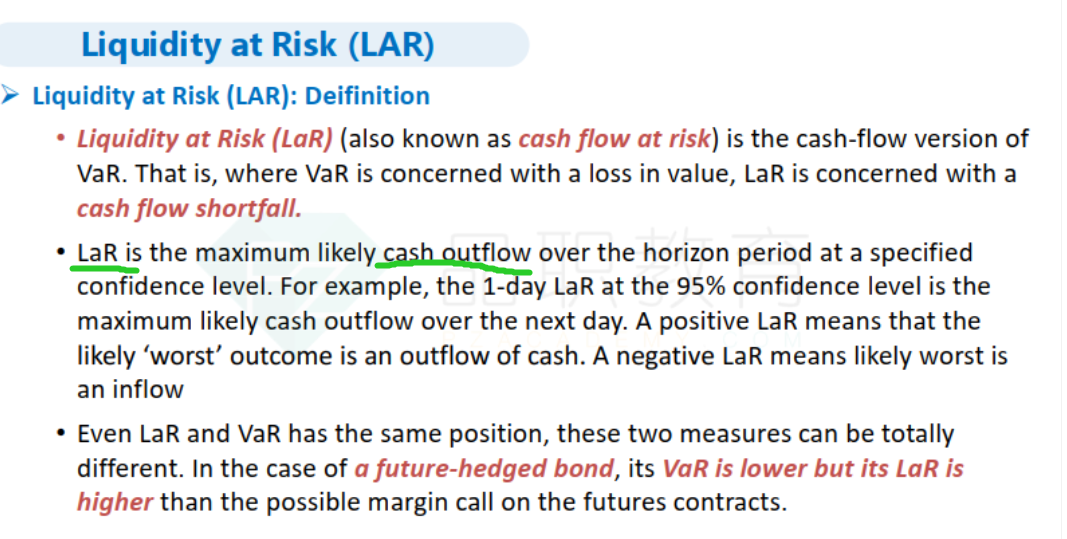

LaR is the maximum likely

cash outflow over the horizon period at a specified confidence level.

A negative LaR means that the

likely ‘worst’ outcome is an outflow of cash. A positive LaR means likely worst

is an inflow.

Even

LaR and VaR has the same position, these two measures can be totally different.

解释:

考点:对Funding Liquidity Risk Measurement的理解

答案: 选项C描述错误,因此本题选C。

解析:

C选项描述错误。Negative LaR对应的是Inflow,Positive LaR对应的是Outflow.

C选项正确的描述为:A

positive LaR means that the likely ‘worst’ outcome is an outflow of cash. A

negative LaR means likely worst is an inflow

LaR is the maximum likely cash outflow over the horizon period at a specified confidence level.

LaR不是cash flow at risk嘛,为什么是maximum cash outflow呢为什么不是inflow呢