NO.PZ2022062761000001

问题如下:

A risk manager is evaluating the price sensitivity of an investment-grade callable bond using the firm’s valuation system. The table below presents information on the bond as well as on the embedded option. The current interest rate environment is flat at 4%.

The convexity of the callable bond can be estimated as:

选项:

A.

0.180

B.

0.360

C.

179.792

D.

719.167

解释:

中文解析:

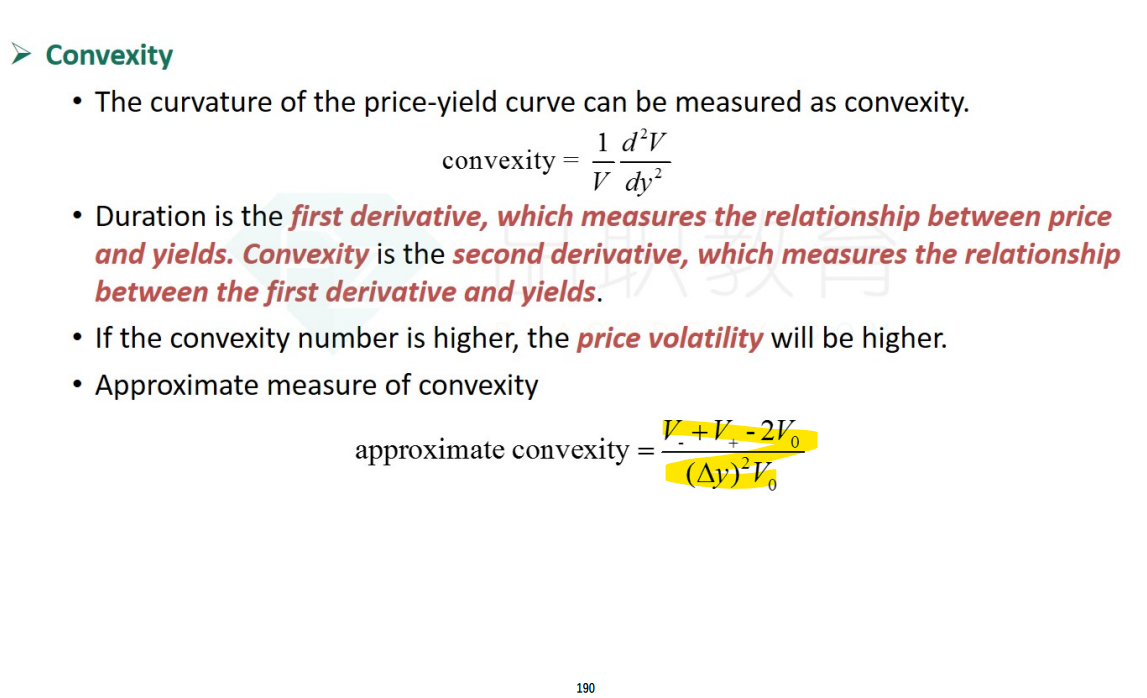

Convexity的计算公式:

已知delta r=0.5%

带入公式即可得出:

Convexity is defined as the second derivative of the price-rate function divided by the price of the bond. To estimate convexity, one must first estimate the difference in bond price per difference in the rate for two separate rate environments, one a step higher than the current rate and one a step lower. One must then estimate the change across these two values per difference in rate. This is given by the formula:

where ∆r is the change in the rate in one step; in this case, 0.05%. Therefore, the best estimate of convexity is:

A is incorrect. 0.1798 is the result obtained when the change in yield in the formula is taken as 0.10% instead of the square of 0.05%.

B is incorrect. 0.3596 is the result obtained when the change in yield in the formula is taken as 0.05% instead of the square of 0.05%.

C is incorrect. 179.7918 is the result obtained when the change in yield in the formula is taken as the square of 0.10% instead of the square of 0.05%.

这个凸性的计算是在基础课的哪一部分中有