NO.PZ2022062761000012

问题如下:

Bank A and Bank B are two competing investment banks. The banks are calculating the 1-day 99% VaR for a long position in an at-the-money call option on a non-dividend-paying stock with the following information:

• Current stock price: USD 120• Estimated annual stock return volatility: 18%

• Current Black-Scholes-Merton call option value: USD 5.20

• Call option delta: 0.6

To compute VaR, Bank A uses the delta-normal model, while Bank B uses a Monte Carlo simulation method for full revaluation. Which bank will estimate a higher value for the 1-day 99% VaR?

选项:

A.

Bank A

B.

Bank B

C.

Both banks will have the same VaR estimate

D.

Insufficient information to determine

解释:

中文解析:

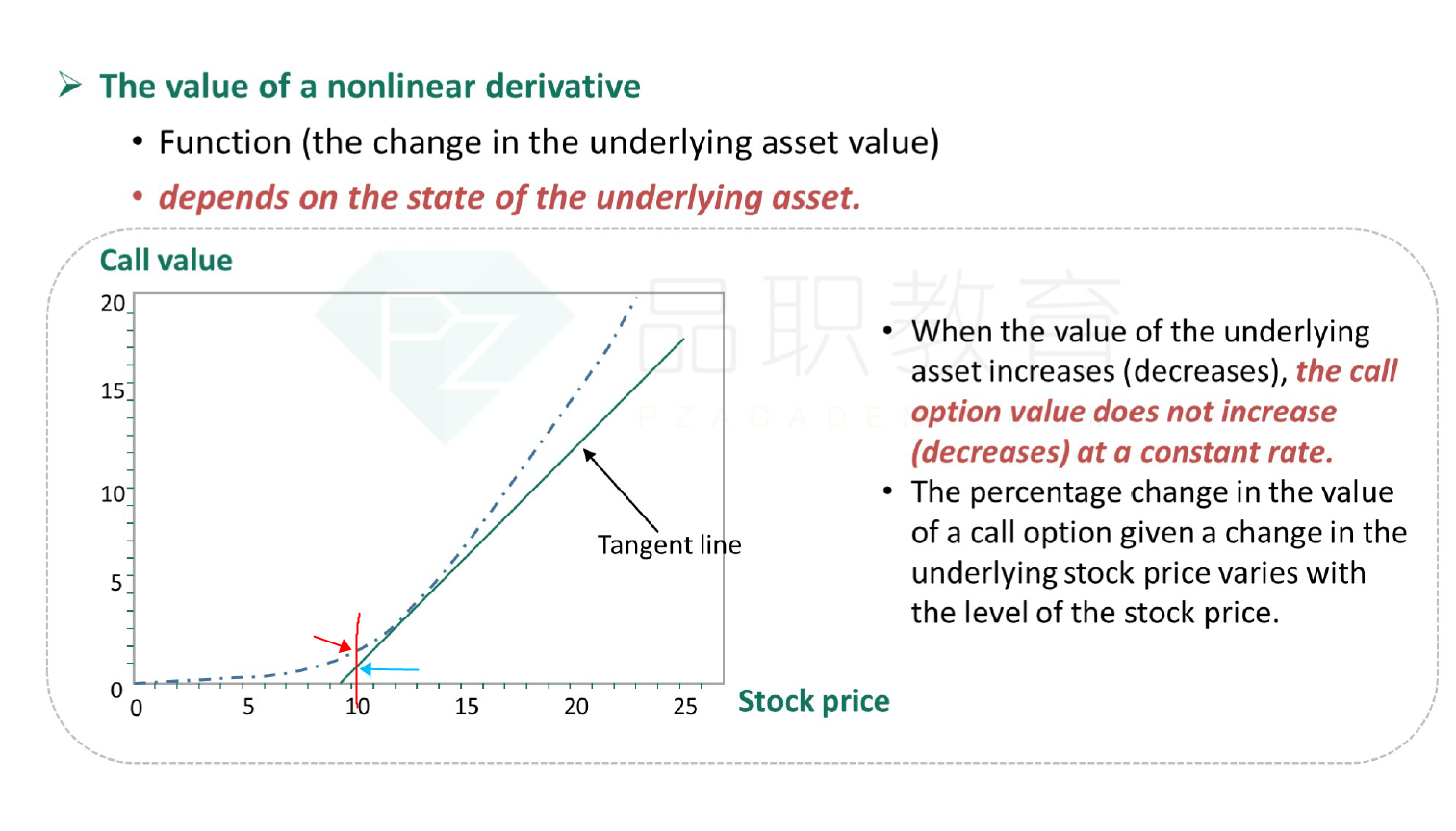

期权的价格函数相对于标的资产的价值是凸的。然而,对于这样一个非线性投资组合,delta-normal 模型只提供了一个线性近似值,它没有捕捉到这种曲率对投资组合价值的积极影响。因此,delta-normal 模型会夸大低期权价值的概率,并且 delta-normal 模型下的 VaR 将始终高于 Monte Carlo 模拟分析进行的全面重估。

The option’s price function is convex with respect to the value of the underlying. However, for such a non-linear portfolio, the delta-normal model provides only a linear approximation which does not capture the positive effect of this curvature on the portfolio value. Therefore, the delta-normal model will overstate the probability of low option values, and the VaR will always be higher under the delta-normal model than a full revaluation conducted by Monte Carlo simulation analysis.

可以详细一点解释一下这个题吗