NO.PZ2022123001000072

问题如下:

At the end of the current year, an investor wants to make a donation of $20,000 to charity but does not want the year-end market value of her portfolio to fall below $600,000. If the shortfall level is equal to the risk-free rate of return and returns from all portfolios considered are normally distributed, will the portfolio that minimizes the probability of failing to achieve the investor's objective most likely have the:

选项:

解释:

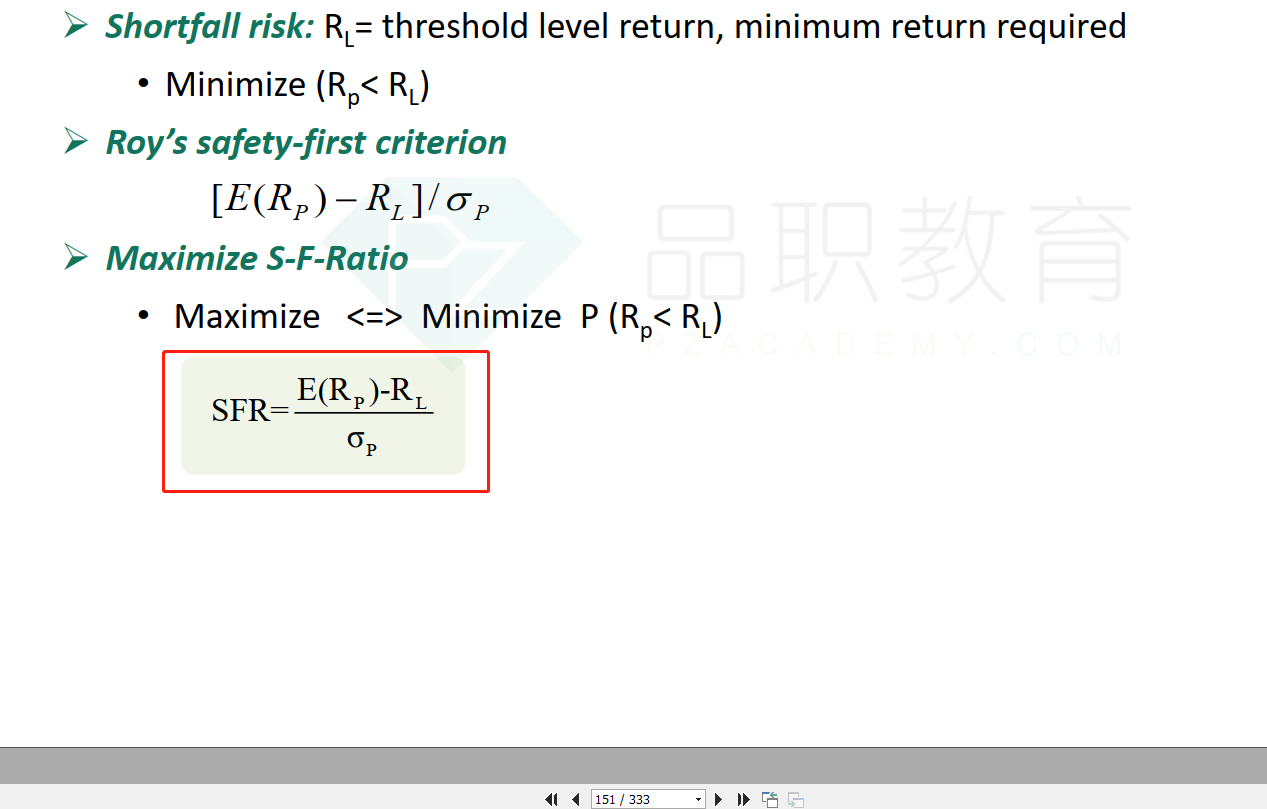

The portfolio with the highest safety-first ratio minimizes the probability that the portfolio return will be less than the shortfall level (given normality). In this problem, the shortfall level is equal to the risk-free rate of return and thus the highest safety-first ratio portfolio will be the same as the highest Sharpe ratio portfolio.