NO.PZ2020011303000220

问题如下:

Consider a zero-coupon bond with a face value of USD 100 and a maturity of ten years. What is the effective convexity of the bond when the ten-year rate is 4% with semi-annual compounding? (Consider one basis-point changes and measure rates as decimals.)

解释:

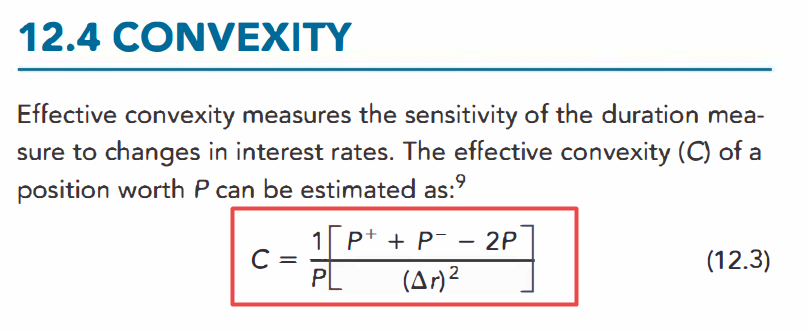

The effective convexity is

题目问:一个零息债券的面值是100USD,期限是10年,当利率是4%,半年付息一次时,effective convexity是多少?

effective convexity=(V++ V- -2*V0)/(V0*1bp^2)

(67.231190+ 67.363145-2×67.297133)/(67.297133×0.0001^2)=102.53

答案中利率平方是怎么来的