NO.PZ202209060200004705

问题如下:

What contingent strategies would Shrewsbury’s DB clients most likely enter into under the scenario he outlines?选项:

A.Short a receiver swap B.Long a payer swaption, short a receiver swaption C.Long a receiver swaption, short a payer swaption解释:

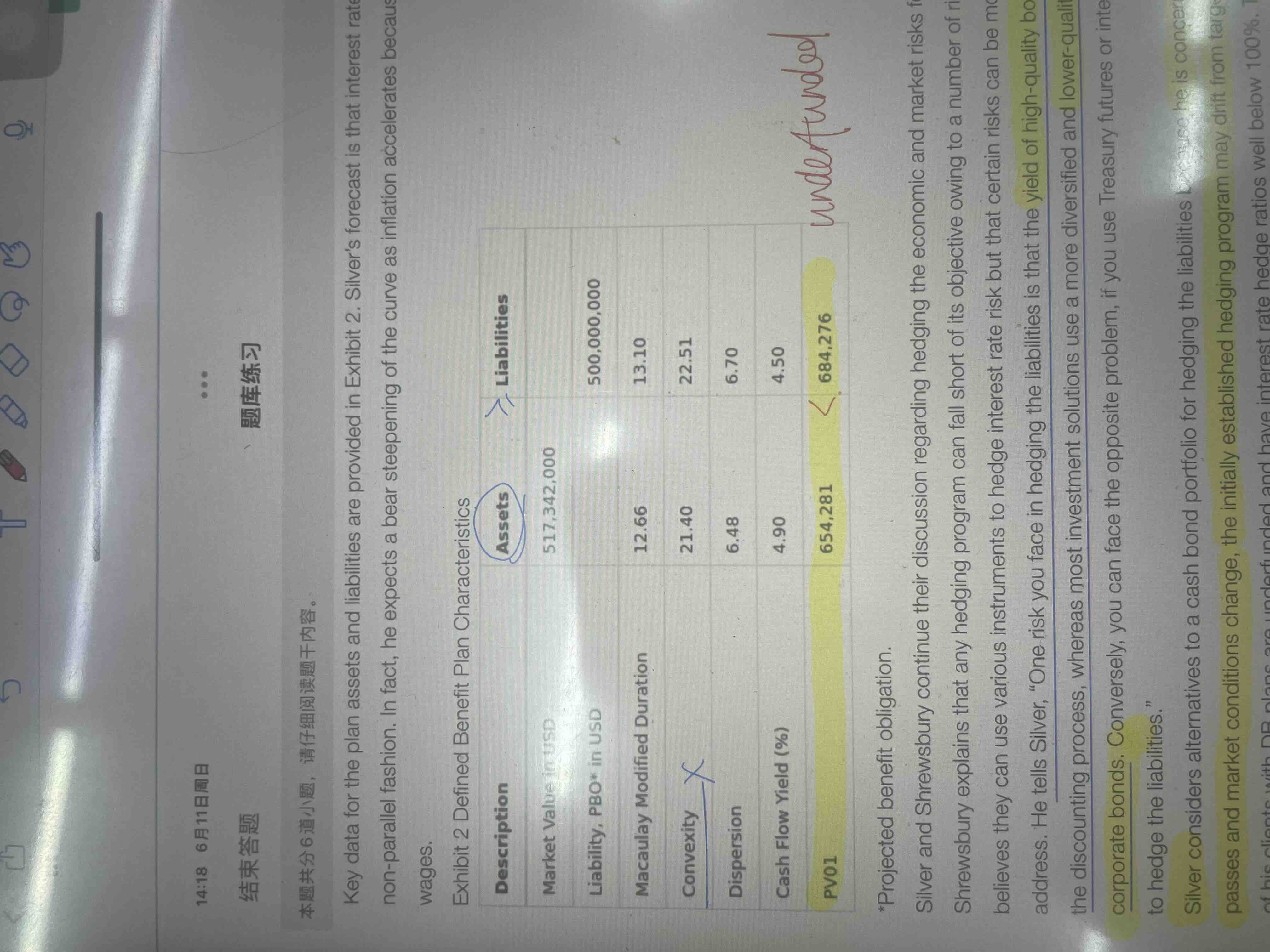

SolutionC is correct. The plan is not fully funded and is also not fully hedged; that is, the money durations of the assets and liabilities are not matched. If the clients’ view is incorrect and rates fall further, the mismatch will result in the liabilities increasing in value while the assets will appreciate by a lesser amount. Swaptions are a contingent security on interest rate swaps. A receiver swaption would allow the plan to receive a fixed (higher) rate if rates rally, but at the cost of the swaption premium. To finance this receiver swaption, the DB plan can sell a payer swaption to collect a premium that finances the receiver swaption. If rates rise above some level, the plan would increase its duration by virtue of being put a swap. The plan may have anticipated closing the duration gap at higher interest rate levels, so being put a swap is in line with an LDI program.

A is incorrect because a receiver swap is not a contingent security.

B is incorrect because it is the reverse of the correct solution—long a receiver swaption, short a payer swaption.

可以麻烦解释一下这道题吗,谢谢