NO.PZ2023040501000052

问题如下:

The board of directors at Sallie-Kwan Industrials (SKI), a publicly traded company, is meeting with various committees following the release of audited financial statements prepared in accordance with IFRS. The finance committee (FC) is next on the agenda to review retirement benefits funding and make recommendations to the board.

Plan A

Benefit: Annual payments for life equal to 1% of the employee’s final salary for each year of service beyond the date of the plan’s establishment

The employer makes regular contributions to the plan in order to meet the future obligation

Closed to new participants; benefits accrue for existing participants

Fair value of assets: €5.98 billion

Present value of obligation: €4.80 billion

Present value of reductions in future contributions: €1.50 billion

Ten-year vesting schedule; 70% of the participants are fully vested

The following case study data to illustrate SKI’s current pension obligation for an average fully vested participant in Plan A with 10 years of prior service:

Current annual salary: €100,000

Years to retirement: 17

Retirement life expectancy: 20 years

Current plan assumptions:

Annual compensation increase: 6%

Discount rate: 4%

Compensation increases are awarded on the first day of the service year; no adjustments are made to reflect the possibility that the employee may leave the firm at an earlier date.

A discussion ensues regarding the effect on the pension obligation, for an average participant, of changing Plan A’s annual compensation increase to 5%.

Based on the case study illustration and the effect of changing the annual compensation rate, the annual unit credit for the average participant would decrease by an amount closest to:

选项:

A.€4,349.

€4,858.

€5,446

解释:

The final year’s estimated earnings at the end of Year 1 for the average participant would decrease by approximately €35,747.71.

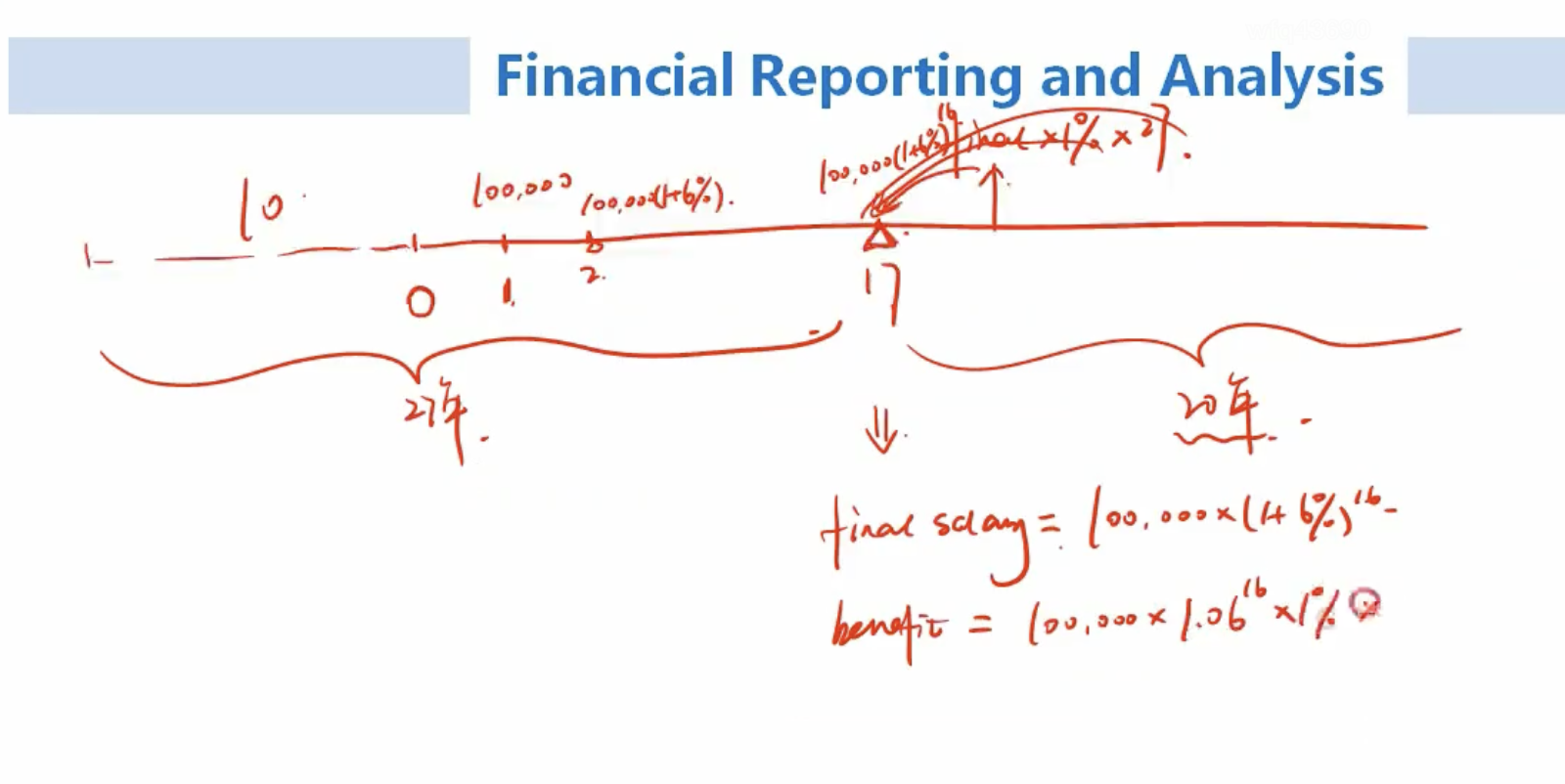

Because there are now 17 years until retirement, there are 16 years until retirement from the end of Year 1. The final year’s estimated earnings, estimated at the end of Year 1, are as follows:

Current year’s salary × [(1 + Annual compensation increase)Years until retirement]

Annual compensation increase of 6%: €100,000 × [(1.06)16] = €254,035.17

Annual compensation increase of 5%: €100,000 × [(1.05)16] = €218,287.46

The estimated annual payment for each of the 20 years (retirement life expectancy) is (Estimated final salary × Benefit formula) × Years of service

Annual compensation increase of 6%: (€254,035.17 × 0.01) × (10 + 17) = €68,589.50

Annual compensation increase of 5%: (€218,287.46 × 0.01) × (10 + 17) = €58,937.61

The value at the end of Year 17 (retirement date) of the estimated future payments is the PV of the estimated annual payment for each of the 20 years at the discount rate of 4%:

Annual compensation increase of 6%: PV of €68,589.50 for 20 years at 4% = €932,153.69

Annual compensation increase of 5%: PV of €58,937.61 for 20 years at 4% = €800,981.35

The annual unit credit = Value at retirement/Years of service:

Annual compensation increase of 6%: €932,153.69/27 = €34,524.21

Annual compensation increase of 5%: €800,981.35/27 = €29,665.98

The annual unit credit for the average participant would decrease by €34,524.21 – €29,665.98 = €4,858.23.

助教你好,我的时间轴画得跟何老师一样,但是我算final salary是100,000(1+6%)^17,现在0时间点到第十七年不就是17次方吗?为什么何老师说t=1时的工资时100,000?题干中的current salary难道不是t=0时的工资吗?