NO.PZ2016022702000007

问题如下:

A one-year zero-coupon bond yields 4.0%. The two- and three-year zero-coupon bonds yield 5.0% and 6.0% respectively.

The five-year spot rate is not given above; however, the forward price for a two-year zero-coupon bond beginning in three years is known to be 0.8479. The price today of a five-year zero-coupon bond is closest to:

选项:

A.0.7119.

B.0.7835.

C.0.9524.

解释:

A is correct.

The forward pricing model can be used to find the price of the five-year zero as

P(T*+T)=P(T*)F(T*,T), SO P(5)=P(3)F(3,2)= 0.8396 x 0.8479 = 0.7119.

考点:forward pricing model

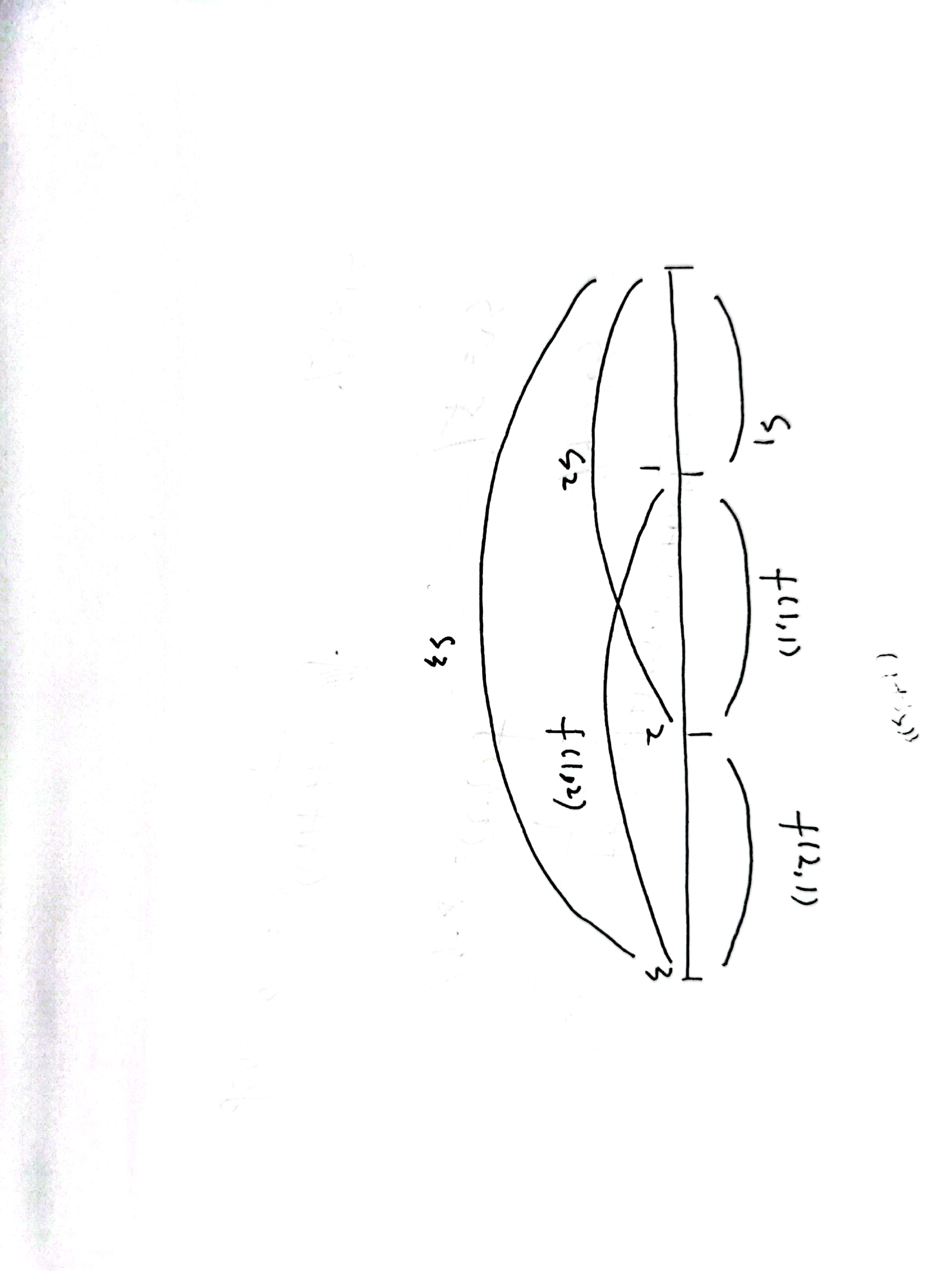

首先将即期利率转化成即期价格P(3)= 。通过forward pricing model得到五年期零息债券的价格,即P(T*+T)=P(T*)F(T*,T),所以P(5)=P(3)×F(3,2)=0.8396×0.8479=0.7119。

老师您好,我是这么算的:

第一步:0.8479=1/f(3,2),得到f(3,2)=0.086

第二步:P0=1/(1.04*1.05*1.06*1.086*1.086),得到P=0.7325