NO.PZ2023032701000069

问题如下:

Mendosa and Raman have a discussion about other approaches that might be appropriate for valuing PRBI’s stock. They make the following statements:

• Statement 1—Raman: Because PRBI’s management is actively seeking opportunities to be acquired, the guideline public company method (GPCM) would be most appropriate. It establishes a value estimate based on pricing multiples derived from the acquisition of control of entire public or private companies. Specifically, it uses a multiple that relates to the sale of entire companies.

• Statement 2—Mendosa: We could also value PRBI using the free cash flow to equity (FCFE) model. But in order to support its rapid growth, the company is expected to significantly increase its net borrowing every year for the next three to five years, and during those years, it could have a significant dampening effect on the company’s FCFE and thus a lower value for its equity.

• Statement 3—Raman: I agree. The residual income (RI) model, also called the “excess earnings method,” does not have the same weakness as the FCFE approach because residual income is an estimate of the profit of the company after deducting the cost of all capital: debt and equity. Furthermore, it makes no assumptions about future earnings and the justified P/B is directly related to expected future residual income.

In regard to the discussion on other approaches between Mendosa and Raman, which of the following statements that they make is most accurate? Statement:

选项:

A.1

B.3

C.2

解释:

Statement 3 by Raman is most accurate. The residual income model, also called the excess earnings method, does not have the same weakness as the FCFE approach, because it is an estimate of the profit of the company after deducting the cost of all capital: debt and equity. Further, it makes no assumptions about future earnings and dividend growth.

助教你好,李老师在经典题里面对于statement 3是讲解了“profit of the company after deducting the cost of all capital: debt and equity”,我对这话没疑问,我的疑问是statement 3最后一句话 “it makes no assumptions about future earnings and the justified P/B is directly related to expected future residual income”。

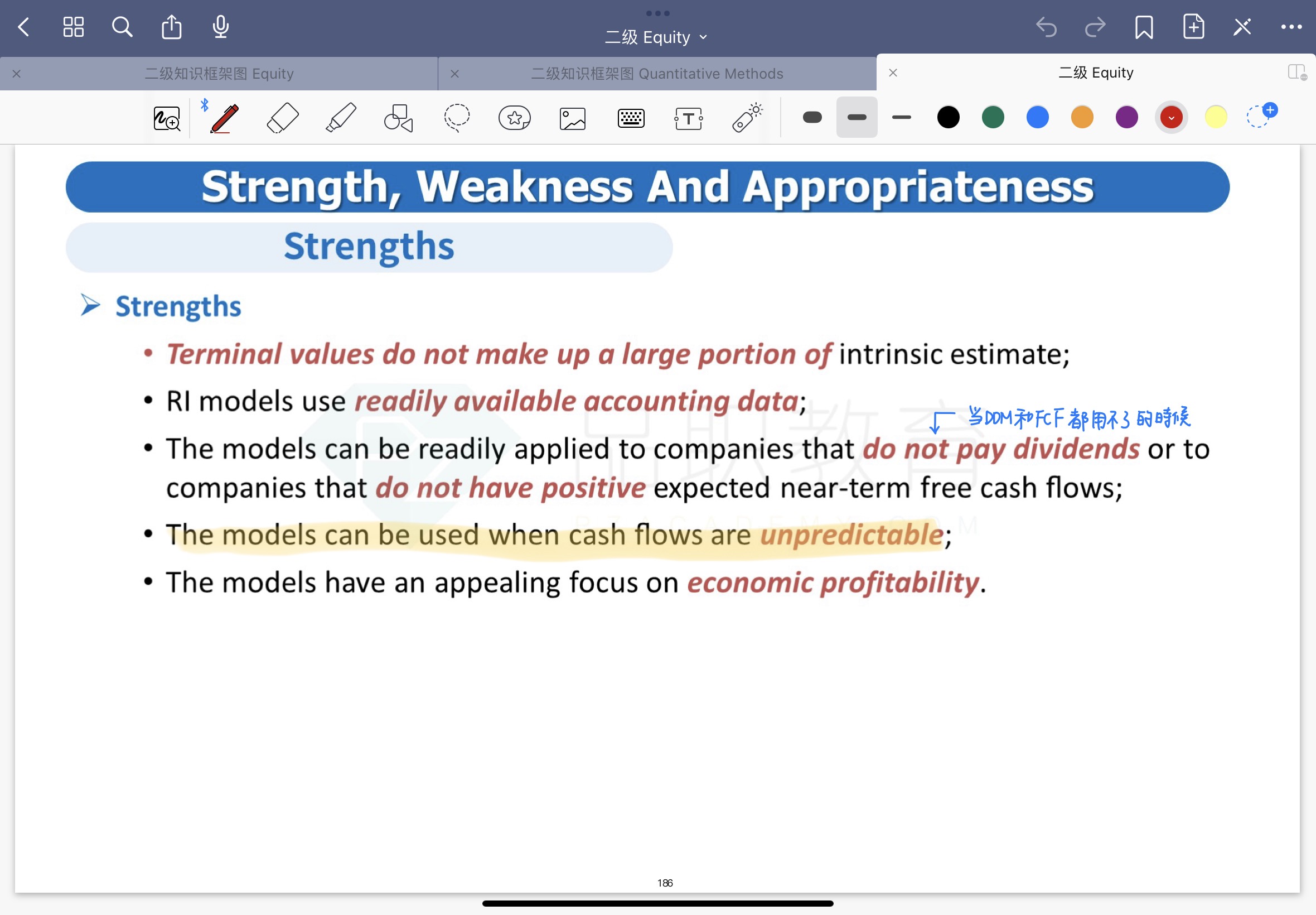

一:【it makes no assumptions about future earnings】跟基础班讲义我标黄的句子似乎是矛盾的,讲义是说一阶段模型假设earning growth rate是恒定,而且ROE>Re的情况是persist indefinitely。

二:【it makes no assumptions about future earnings】这句话若是正确的结论,那它这个算是RI 模型的优点?它与下图标黄句子是有关联的吗?