NO.PZ2018111303000107

问题如下:

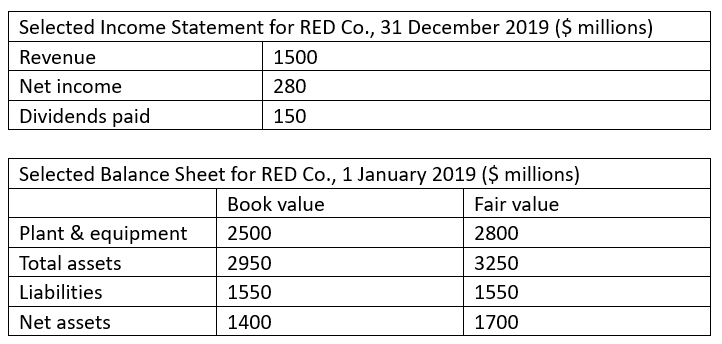

On 1 January 2019, PET company acquired a 20% equity interest with voting power in RED Co. for $400 million. PET company has representation on RED's board of directors and participates in RED’s policymaking process. Lisa, an analyst, gathers selected financial information for RED in 2019. The plant and equipment are depreciated on a straight-line basis and have 10 years of remaining life.

The carrying value of PET’s investment in RED at the end of 2019 is closest to:

选项:

A.

$420 million.

B.$426

million.

$450 million.

解释:

答案:A

解析:equity method中,investment的后续计量用share result的方法:

① 被投资企业的NI按比例增加投资方B/S上的investment,对于share的被投资企业的NI,需要根据投资时被投资公司fair value和book value的差异调整,主要调整三项:COGS、depreciation和amortization。本题涉及的是depreciation,RED公司PPE在投资时的fair value比book value多300(=2800-2500),按照fair value应该每年多计提300/10=30的折旧,多计提的折旧会减少被投资企业的NI,因此会减少投资方的investment的账面价值。

②如果有分红,则按比例减少investment并增加投资方B/S的cash。

计算过程:

400+20%×(280-30)-20%×150=400+50-30=420

请问减去dividends的原因是这个经济内容已经通过cash增加体现了吗?