NO.PZ2022120702000004

问题如下:

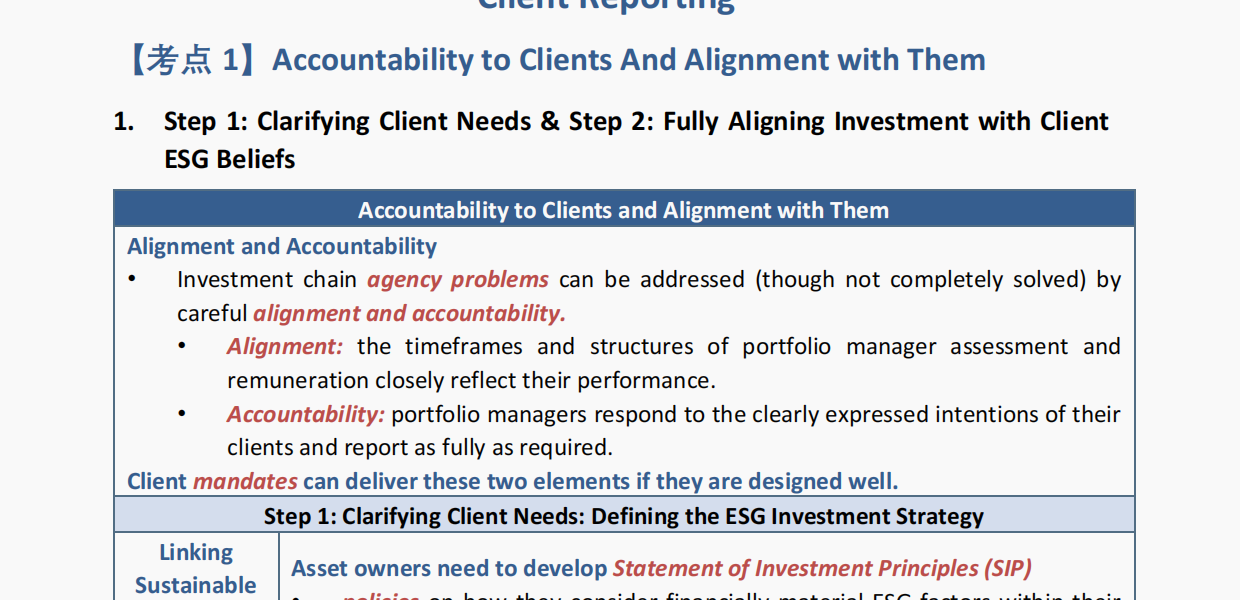

A Sovereign Wealth Fund selecting an investment manager with an ESG strategy is likely to focus more on the manager’s approach to:

选项:

A.ESG engagement and stewardship.

B.Integrating MSCI data while ESG scoring the portfolio.

C.Liquidity of the portfolio and short-term performance.

D.Quantitative analysis of portfolio attribution vs. the benchmark.

解释:

主权财富基金在选择具有ESG策略的投资经理时,更关注该基金经理ESG参与和管理的方法。这个题目出自教材哪一页