NO.PZ2021061603000027

问题如下:

The average return for Portfolio A over the past twelve months is 3%, with a standard deviation of 4%. The average return for Portfolio B over this same period is also 3%, but with a standard deviation of 6%. The geometric mean return of Portfolio A is 2.85%. The geometric mean return of Portfolio B is:

选项:

A.less than 2.85%. B.equal to 2.85% C.greater than 2.85%.解释:

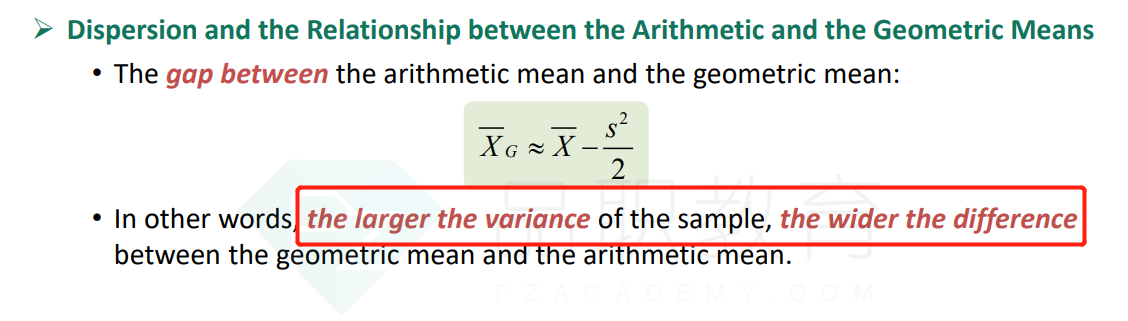

A is correct. The more disperse a distribution, the greater the difference between the arithmetic mean and the geometric mean。

所以标准差越大,算术平均和几何平均的差距越大。

A组合的标准差是4%,B的标准差是6%。B的标准差比A大,算数平均的几何平均的差距也要比组合A更大,所以几何平均应该是要小于2.85%,这样差距才会更大。

A组合的标准差是4%,B的标准差是6%。B的标准差比A大,算数平均的几何平均的差距也要比组合A更大,所以几何平均应该是要小于2.85%,这样差距才会更大。为什么不是几何平均大于2.85%,只是说了标准差大了。波荡就比较大,差距大