NO.PZ2018123101000031

问题如下:

Madison describes features of equilibrium and arbitrage-free term structure models.

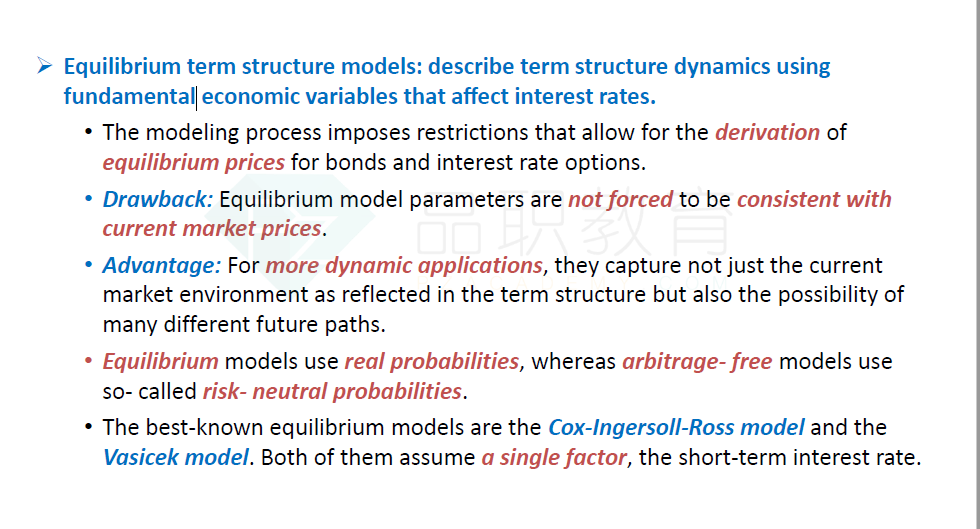

Statement 1: Equilibrium term structure models are factor models that use the observed market prices of a reference set of financial instruments, assumed to be correctly priced, to model the market yield curve.

Statement 2: In contrast, arbitrage-free term structure models seek to describe the dynamics of the term structure by using fundamental economic variables that are assumed to affect interest rates.

Which of Madison’s statement(s) regarding equilibrium and arbitrage-free term structure models is incorrect?

选项:

A.Statement 1 only

B.Statement 2 only

C.Both Statement 1 and Statement 2

解释:

C is correct.

考点:Equilibrium Term Structure Models and Arbitrage-free Models

解析:注意题干是让选项Incorrect的Statement,两种说法都不正确,因此选择C。均衡期限结构模型是因子模型,通过用影响利率的基本经济变量来描述利率期限结构。

无套利期限结构模型,假设市场定价正确,然后使用市场价格来模拟市场收益率曲线。

老师您好,请问正确的statement2在课件哪里有描述啊?好像没看过这段话。