NO.PZ201512300100001607

问题如下:

Using the guideline public company method, Beckett should estimate the value of 100% of LiveLong Foods to be:

选项:

A.

$118,608,000

B.

$121,200,000

C.

$124,608,000

解释:

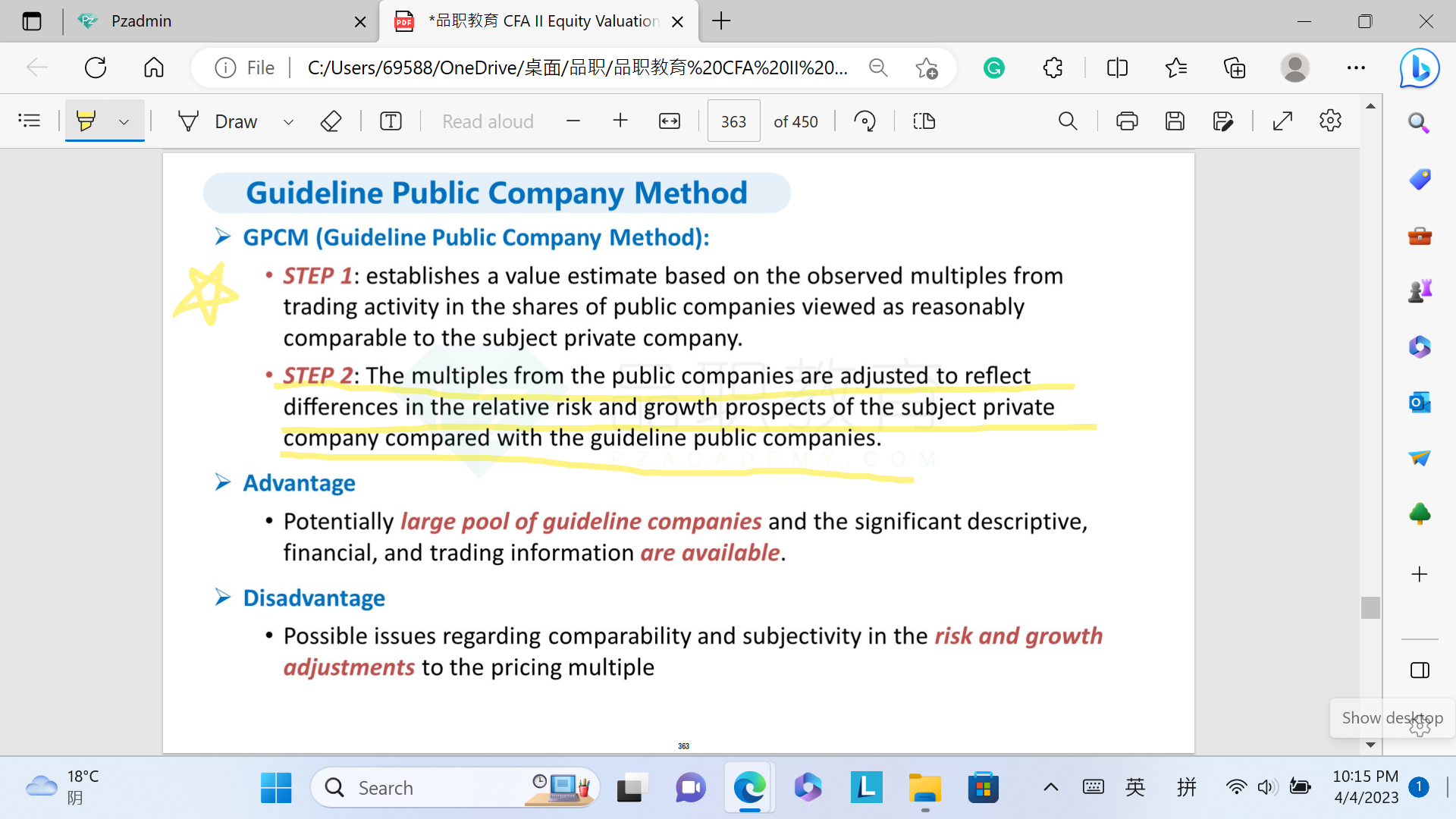

A is correct. Using the guideline public company method, the value of LiveLong Foods is calculated in two steps:

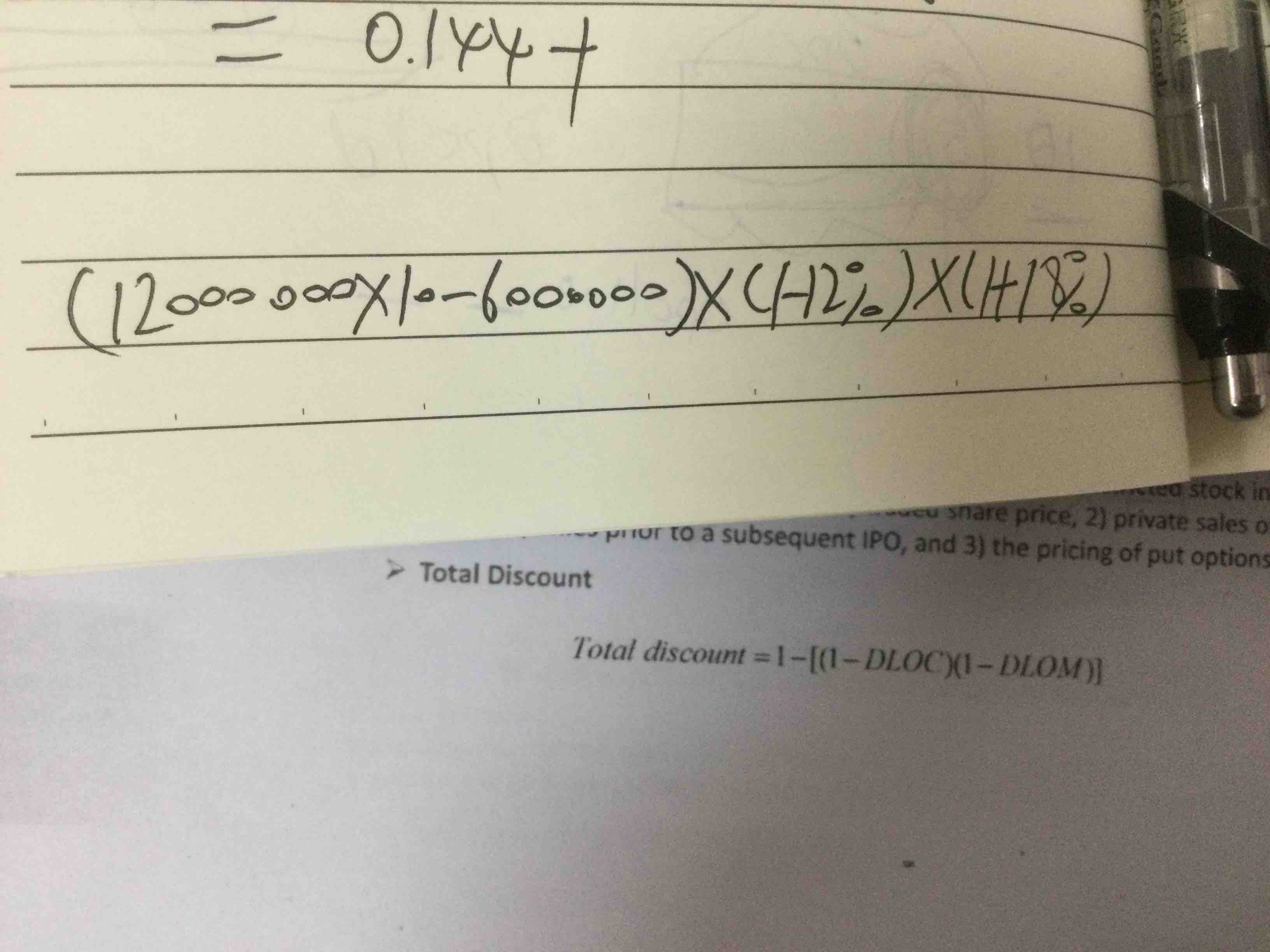

First, calculate the pricing multiple for LiveLong Foods:

Second, calculate the valuation of LiveLong Foods:

为啥不是这个算法?既然都是调整权益的