NO.PZ2019052801000049

问题如下:

A bank entered into a swap with two years to maturity as a floating rate payer. The fixed rate is 4%, with annal payments. The notional priciple is $5,000,000. The spot interest rates are as follows: one year, 3.5%; two years, 4.5%. Today is the reset day, the current value of the swap is closest to:

选项:

A.

$54,437.

B.

$-54,437.

C.

-$30,125.

D.

$30,125.

解释:

B is correct.

考点:利率互换估值.

解析:

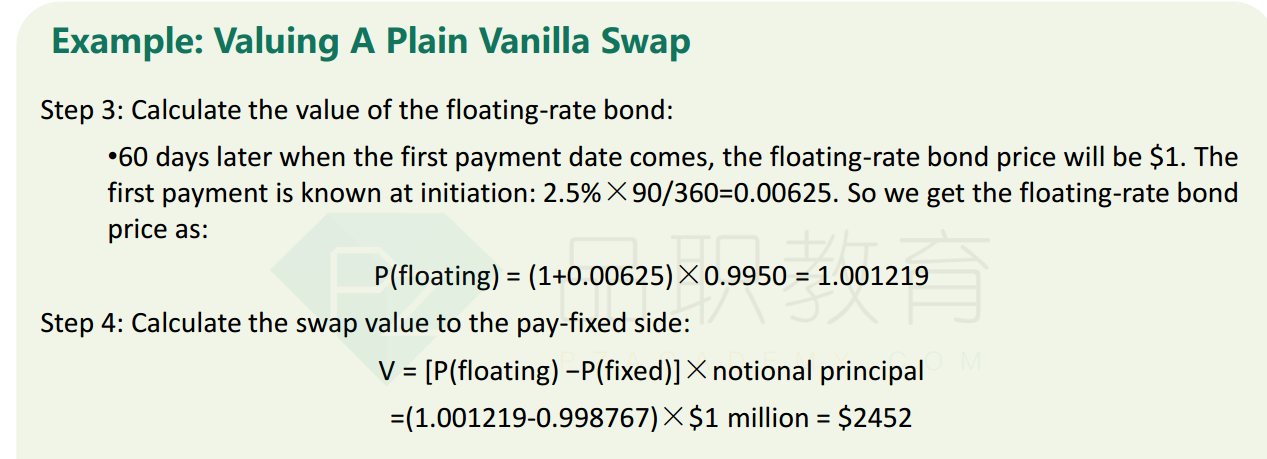

支浮动的一方可以看作一个浮动利率债券,浮动利率债券在reset day 价值回归面值。

收固定的一方可以看作一个固定利率债券,

请问这个公式是什么意思,是哪里的知识点