NO.PZ2016012102000099

问题如下:

Goodluck Co. has an operating profit margin of 10%, asset turnover ratio of 1.5, financial leverage multiplier of 1.6 times, and interest burden of 0.8. Company's ROE is 0.144, please calculate the company's average tax rate.

选项:

A.25%

B.75%

C.65%.

解释:

A is correct.

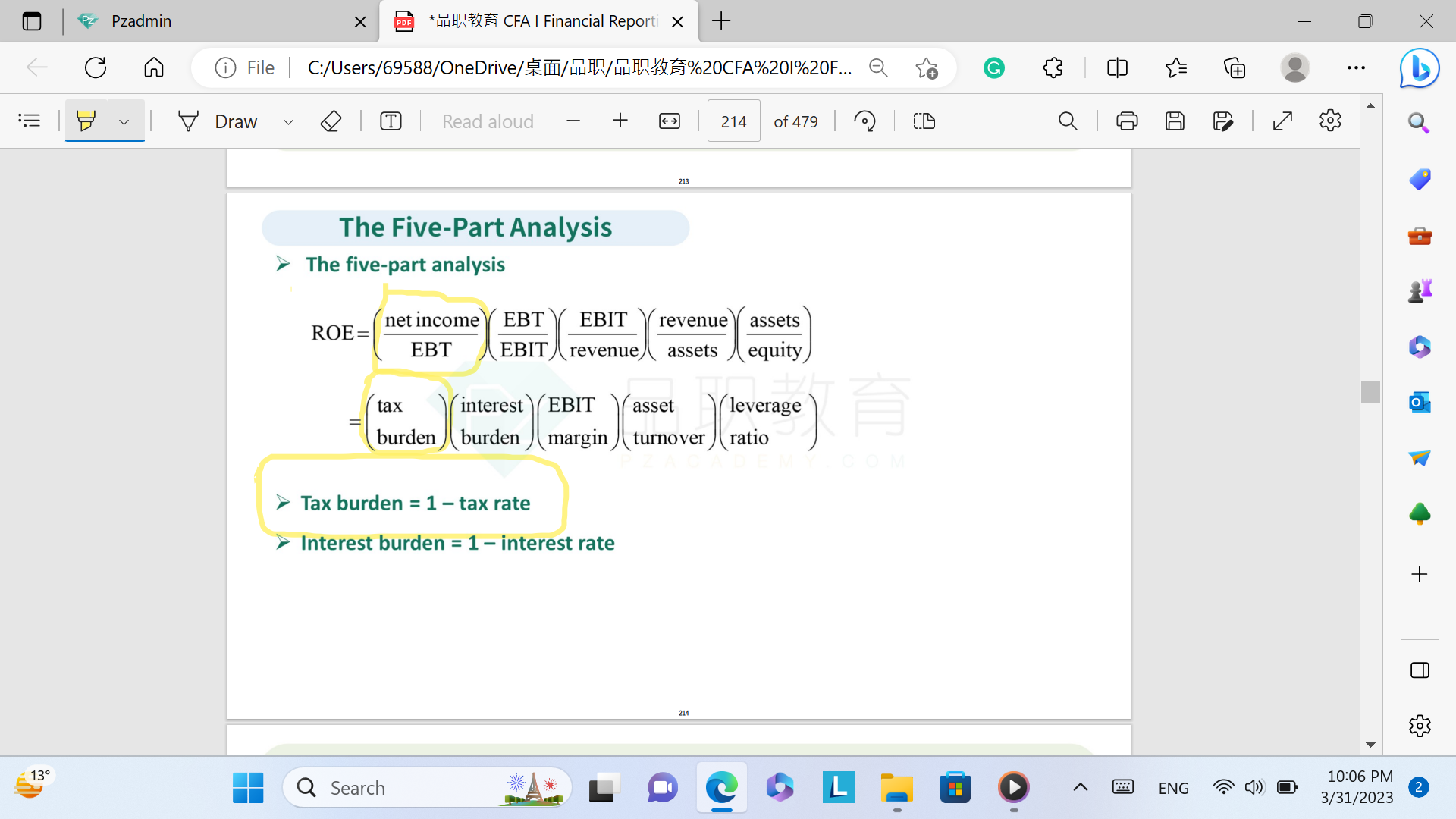

tax burden=0.144/(0.8 x 0.1 x 1.5x 1.6)=0.75

average tax rate =1-0.75=0.25.

可以解释一下tax burden 的意思吗?