问题如下图:

选项:

A.

B.

C.

解释:

请问2和3都错在哪里了?~

发亮_品职助教 · 2018年05月08日

同样,利用这道题把结论记住。

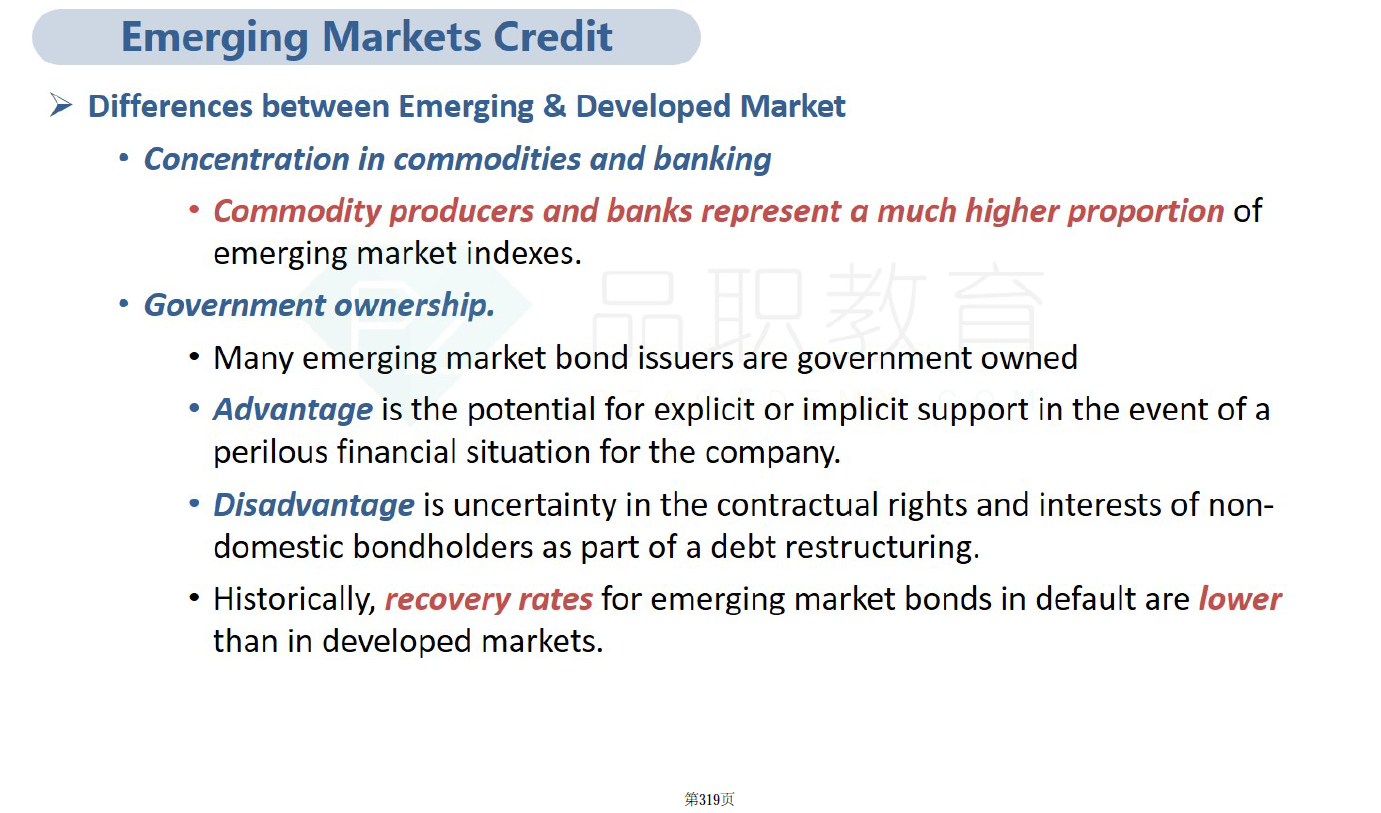

Difference 2的错误:平均而言,EM recovery rate是比developed 要低的。

Historically, recovery rates for emerging market bonds in default, on average, are lower than in developed markets.

Difference 3的错误:EM的Bonds主要集中在investment-grade的Lower portion;和High-yield的Hihger portion。

Compared with that of developed markets, the emerging market credit universe has a high concentration in both the lower portion of the investment-grade rating spectrum and the upper portion of high yield.

讲义相关内容: