NO.PZ201812100100000608

问题如下:

Pereira should forecast that the ROE for Globales is likely to decline:

选项:

A.more slowly than that of the industry competitor.

B.at the same rate as the industry competitor.

C.more rapidly than that of the industry competitor.

解释:

A is correct.

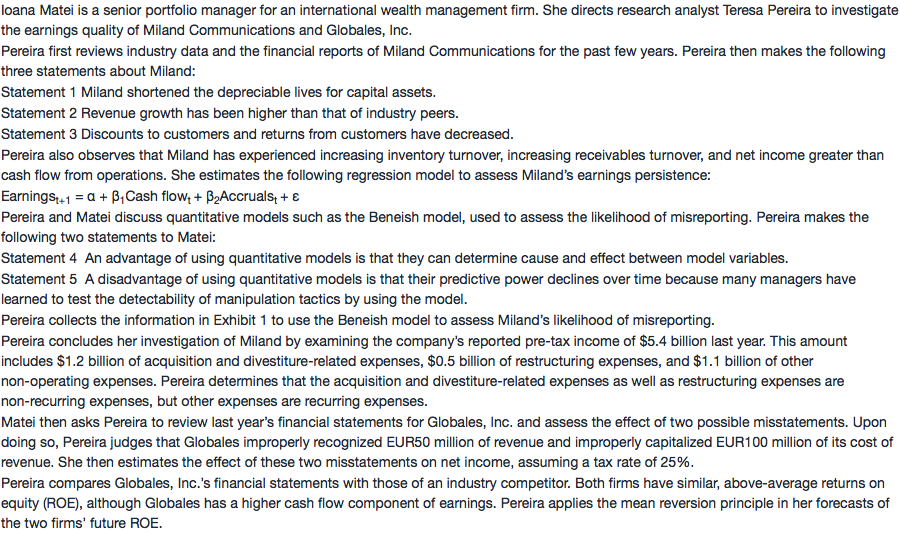

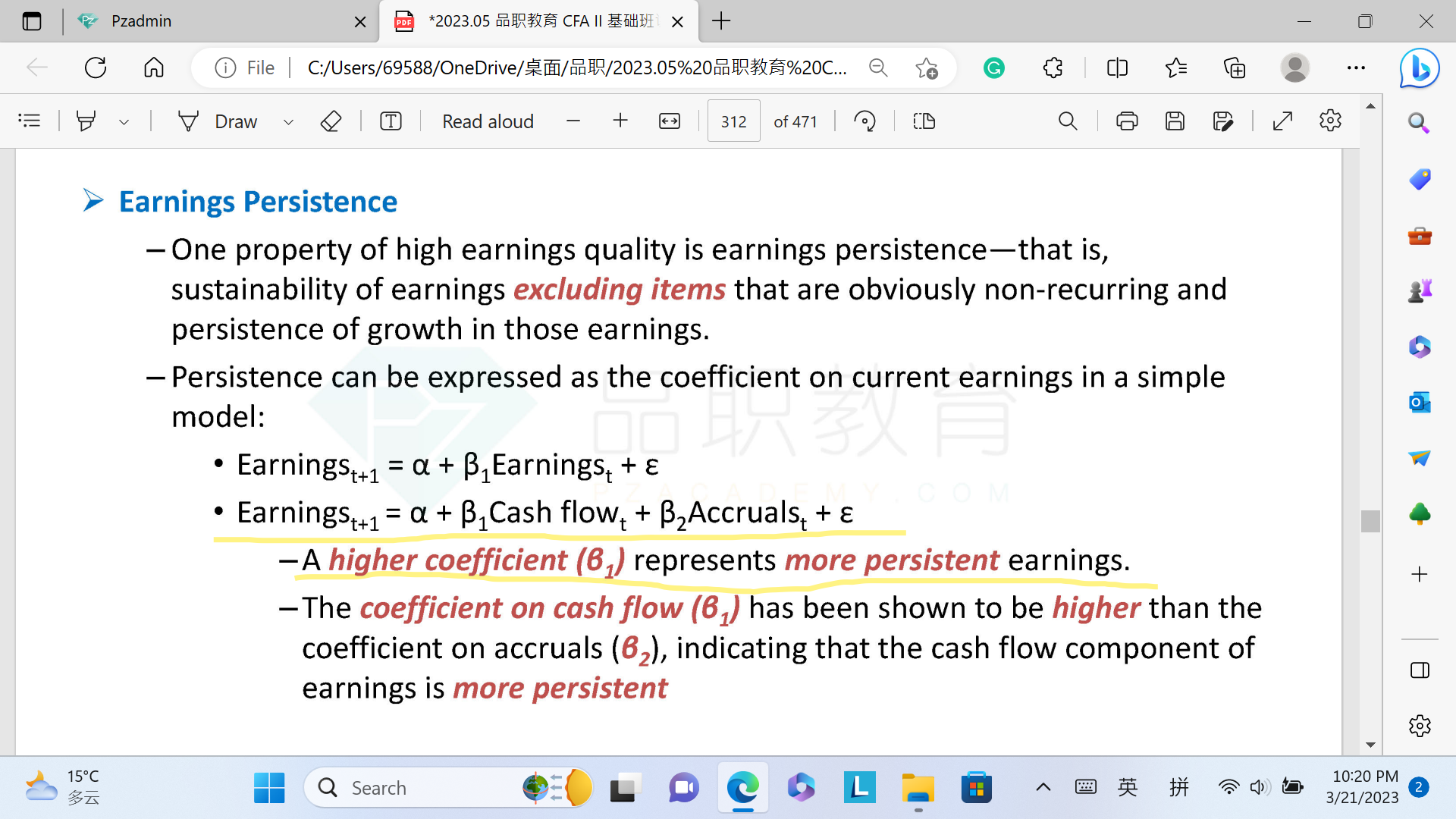

Based on the principle of mean reversion, the high ROE for both firms should revert towards the mean. Globales has a higher cash flow component to its return than the peer firm, however, so its high return on common equity should persist longer than that of the peer firm. The peer firm has a higher accruals component, so it is likely to revert more quickly.

解析:earning具有mean reversion的特点,高于或者低于平均的earning最终都会回归到平均值。G公司和竞争者现在的ROE都高于行业平均,意味着两家公司以后的ROE都会趋于平均值,也就是earning下降。G公司相比其竞争者,cash flow占earning的比重更大,也就是G公司的earning更具有持续性,下降的也会更慢。

从ROE的杜邦分析来看是看不出来A选项的,所以我选了B。那这题目是完全定性判断吗?