NO.PZ2019052801000061

问题如下:

If the price of a stock is expected to be volatile in the following months, but whether it will increase or decrease is uncertain, which of the following strategy is most beneficial for investors?

选项:

A.A short position in butterfly spread.

B.Create a neutral calendar spread.

C.A long position in butterfly spread.

D.Create a bullish calendar spread.

解释:

A is correct.

考点:spread strategies

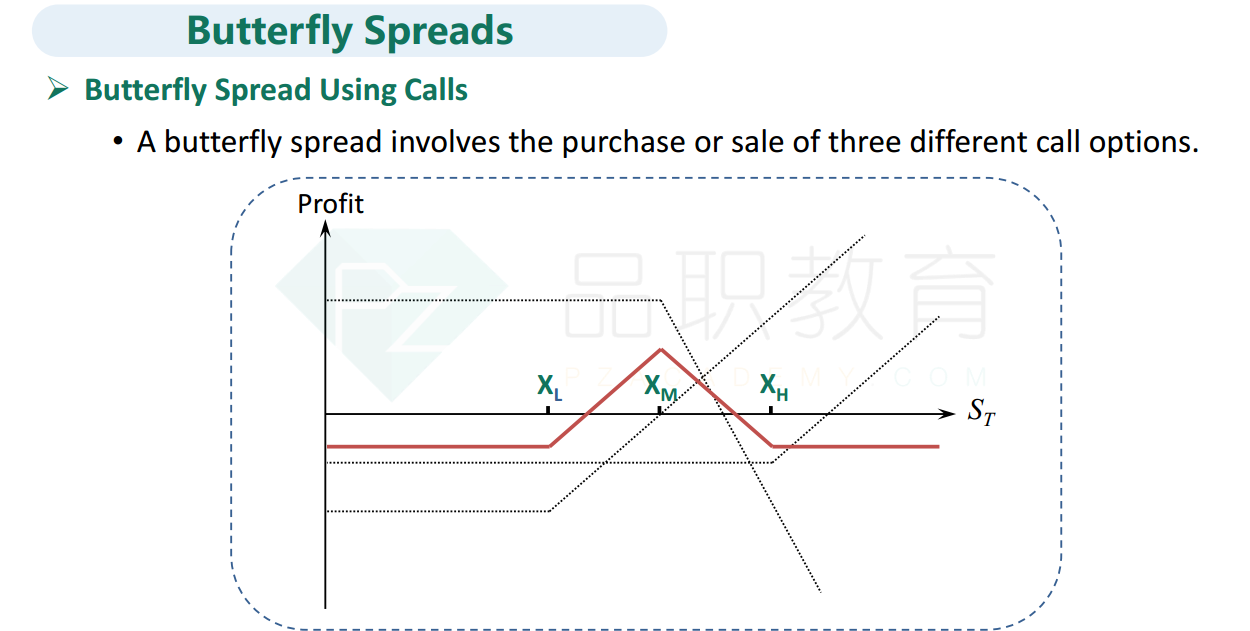

解析:Short butterfly spread在股价接近Xm时面临少量亏损,在股价大幅波动远离Xm时获得收益,A正确。

Long butterfly spread在股价接近Xm时获得收益,在股价大幅波动远离Xm时面临少量亏损,C错误。

Calender spread的期权头寸具有相同的标的物、相同的执行价格,但不同的到期日。与butterfly spread相似,当股票价格接近执行价格,获得收益。

为啥我记得老李讲的是 不管看涨看跌 接近Xm都有最大收益呢, 有点不明白