NO.PZ2022061307000048

问题如下:

Question Which of the following types of indexes is most appropriate as a model portfolio for a consumer goods exchange-traded fund (ETF)?选项:

A.Fundamentally weighted B.Sector C.Style解释:

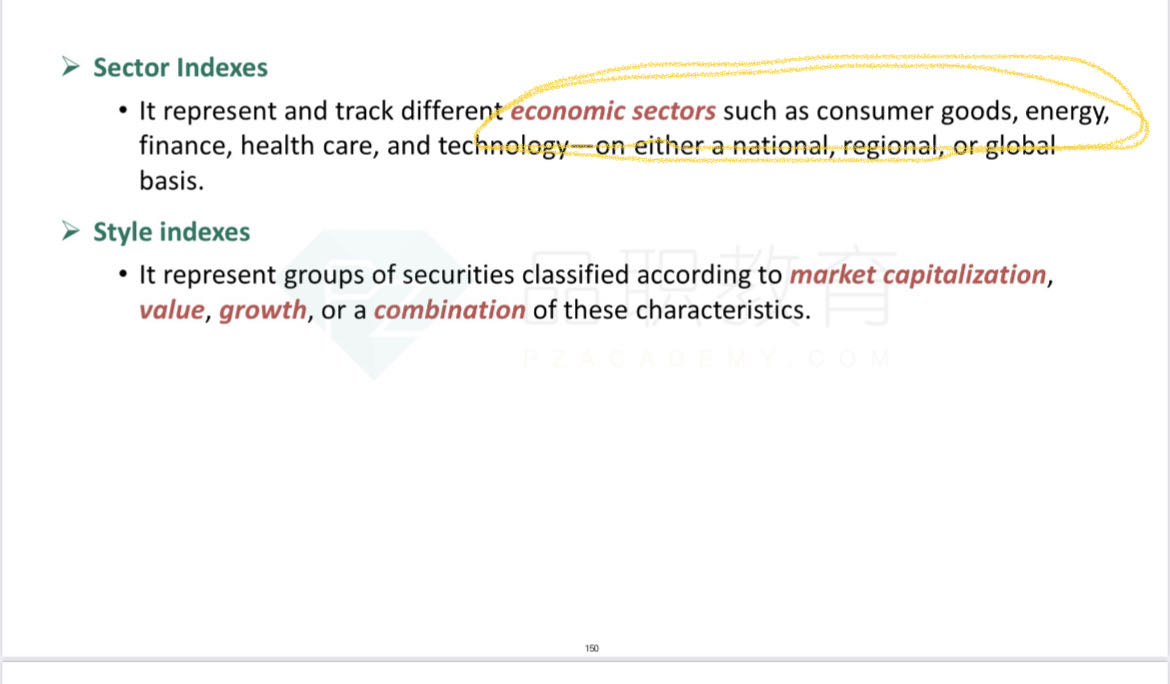

SolutionB is correct. Sector indexes represent and track different economic sectors—such as consumer goods, energy, finance, health care, and technology—on a national, regional, or global basis. Sector indexes also serve as model portfolios for sector-specific ETFs (e.g., for a consumer goods ETF).

A is incorrect. Fundamentally weighted indexes use measures such as book value, cash flow, revenues, earnings, dividends, number of employees or GDP of countries to weight the constituent securities. Securities of different sectors and styles could be included in the same fundamentally weighted index. Therefore, fundamentally weighted indexes do not serve as model portfolios for consumer goods ETFs.

C is incorrect. Style indexes represent groups of securities classified according to market capitalization, value, growth, or a combination of these characteristics, but do not represent economic sectors such as consumer goods. Therefore, style indexes do not serve as model portfolios for consumer goods ETFs.

请问知识点在讲义的什么地方?