NO.PZ201602060100001503

问题如下:

In response to the board’s first question, Templeton would most likely reply that such a change would be justified if:

选项:

A.the inflation rate in the United States became hyperinflationary.

B.management wanted to flow more of the gains through net income.

C.Consol-Can were making autonomous decisions about operations, investing, and financing.

解释:

C is correct.

The Canadian dollar would be the appropriate reporting currency when substantially all operating, financing, and investing decisions are based on the local currency. The parent country’s inflation rate is never relevant. Earnings manipulation is not justified, and at any rate changing the functional currency would take the gains off of the income statement.

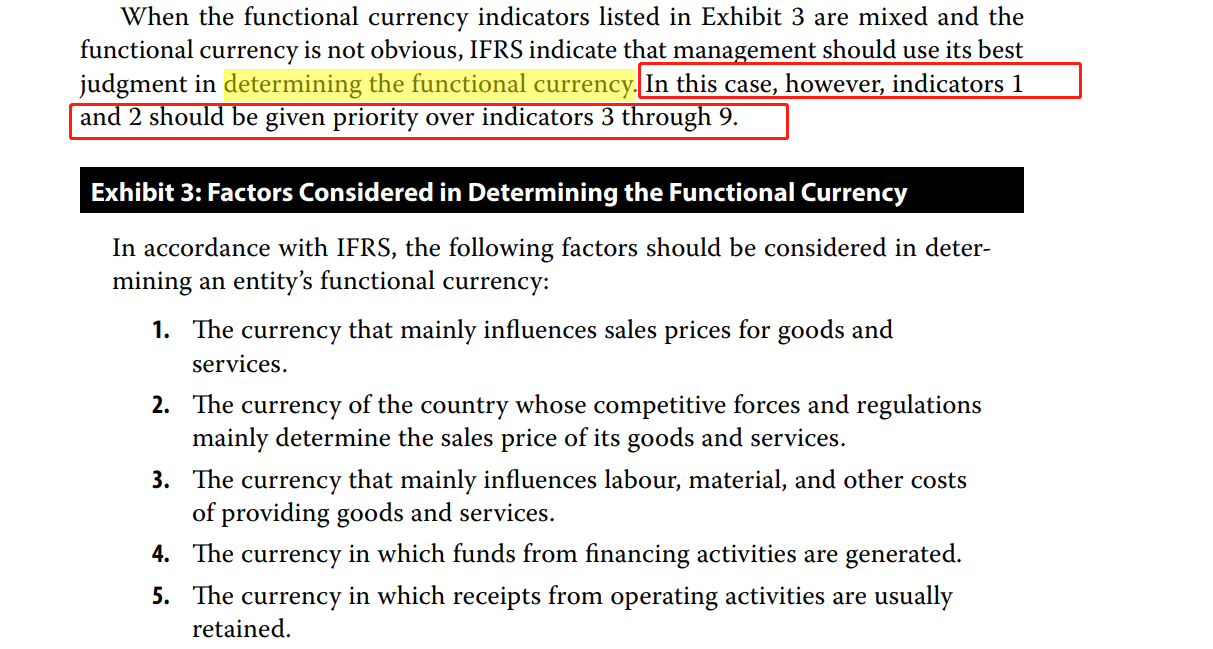

考点:functional currency

解析:根据题目背景信息,董事会的第一个问题是“Would there be a reason to change the functional currency to the Canadian dollar”,是否有理由把functional currency改成加拿大元。

现在functional currency是美元,转换方法是temporal method。如果functional currency改成加拿大元,则转换方法就要改成current rate method。(这一点如果无法判断请回顾基础知识)

A选项:母公司的通胀率是不影响决策的,在恶性通胀情况下调整转换方法,始终说的都是子公司出现hyperinflation的情况,跟母公司inflation无关,A选项不正确。

B选项说的是管理层想要让NI里面有更多的收入。那我们就要判断一下改成current rate method之后是否会有新的gain确认到损益表中。本来用temporal method,translation gain是记入损益表的,但如果改成用current rate method,translation G/L是记入OCI的,所以不会flow more gain到损益表,反而会少。选项B不正确。

C选项:当子公司独立进行经营、投资、融资决策时,其functional currency就应该是其local currency,即加拿大元,因此选项C完全是把functional currency改成加拿大元的合理理由。

No.PZ201602060100001503

来源: 原版书

In response to the board’s first question, Templeton would most likely reply that such a change would be justified if:

您的回答C, 正确答案是: C

A

the inflation rate in the United States became hyperinflationary.

B

management wanted to flow more of the gains through net income.

C

正确

Consol-Can were making autonomous decisions about operations, investing, and financing.

请问判断子公司是否独立运行的时候,operations, investing, and financing里面哪个是最重要的因素?