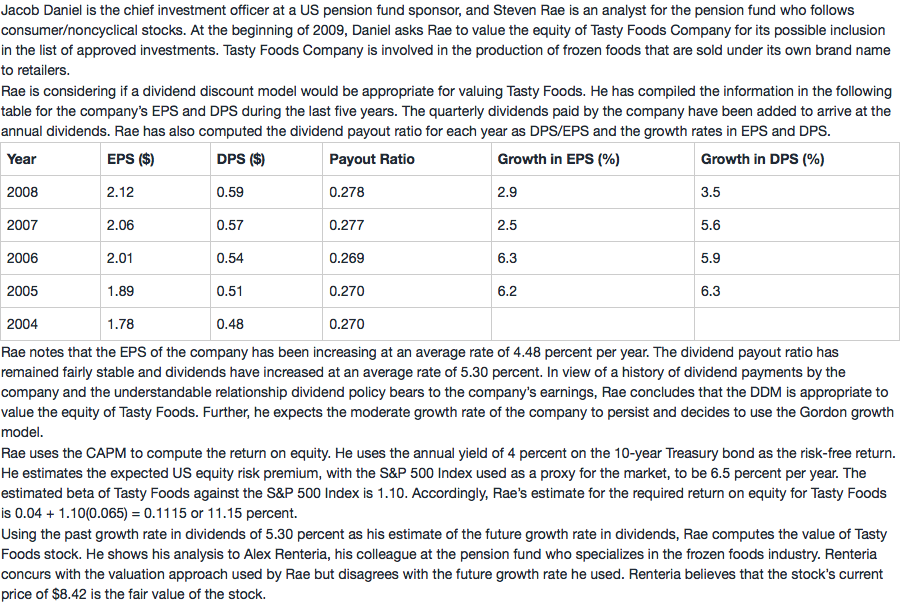

NO.PZ201512300100000801

问题如下:

1. Which of the following is closest to Rae’s estimate of the stock’s value?

选项:

A.

$10.08.

B.

$10.54.

C.

$10.62.

解释:

C is correct.

Using the Gordon growth model,

$$V_0=\frac{D_1}{r-g}=\frac{0.59(1+0.0530)}{0.1115-0.0530}=\$10.62$$

为什么可以5.3%来作为g?题目中给了EPS的增长率4.48%,给了Div的增长率5.3%,这两个为什么会不一样呢?按照DDM,不应该E的增长率和D的增长率是一样的吗?这两个增长率不一样可以用DDM模型吗?