NO.PZ2018111303000004

问题如下:

PZ company is an education company headquartered in China. It complies with IFRS. In 2018, PZ held a 20% passive equity ownership interest in T-internet company. At the end of 2018, PZ company decide to increase its ownership interest to 50% T-internet on 1 January 2019 through a cash purchase. There are no intercompany transactions. The financial statement data for PZ company and T-internet company in the following table:

At the end of 2019, PZ company’s net profit margin is highest under which of the following accounting method:

选项:

A.No impacts.

B.Acquisition method.

C.Equity method..

解释:

C is correct.

考点:不同的会计方法下对会计比率的影响

解析:net profit margin=NI/Revenue

如果是control,就是用Acquisition method,acquisition method需要把子公司的全部revenue并到母公司的revenue,全部的NI都并到母公司之后还要减掉归属于少数股东权益的部分,最终的结果就是合并后的NI=母公司的NI+子公司NI归属于母公司的部分,即(2,300+820*50%)/(7,000+2,500)=0.29

如果是significant influence,用equity method,不需要合并子公司的revenue,但要share result,被投资公司NI中归属于投资公司的部分要加到投资公司的NI中,即:(2,300+820*50%)/7,000=0.39。

所以C选项的net profit margin最高。

这一题不计算也能定性的得出结论:

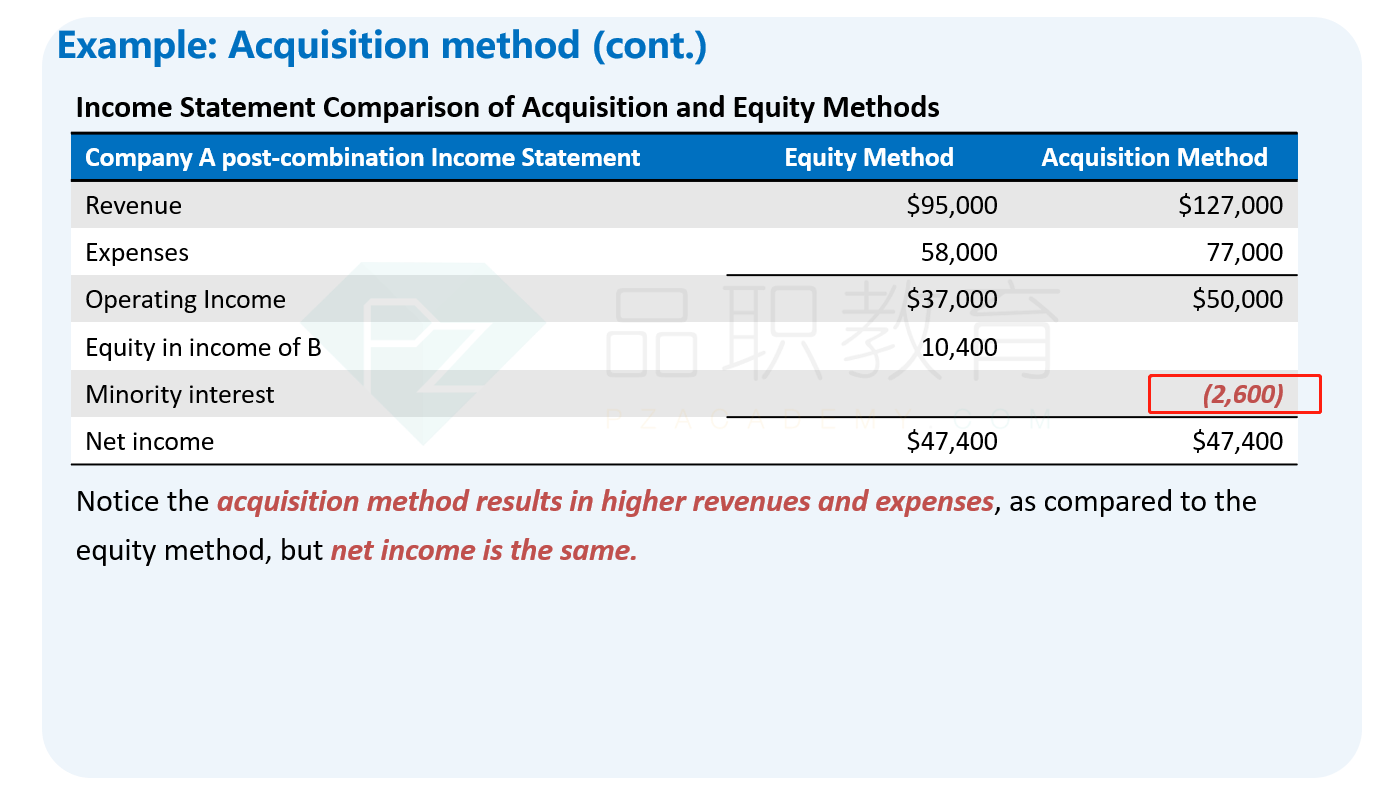

equity method和acquisition method下,NI是一样的(上课讲过的结论),equity method不合并revenue,而acquisition method需要合并revenue,因此equity method下net profit margin更高。

老师,请问下为什么equity method和acquisition method下,NI是一样的(上课讲过的结论)?这里不是很理解,可以展开具体说下 吗?