NO.PZ202208300100000204

问题如下:

Immediately following its business combination with HiQ Printers, the total shareholders’ equity (in thousands) on Suburban’s consolidated financial statements is closest to:选项:

A.$532,200.00 B.$577,000.00 C.$571,800.00解释:

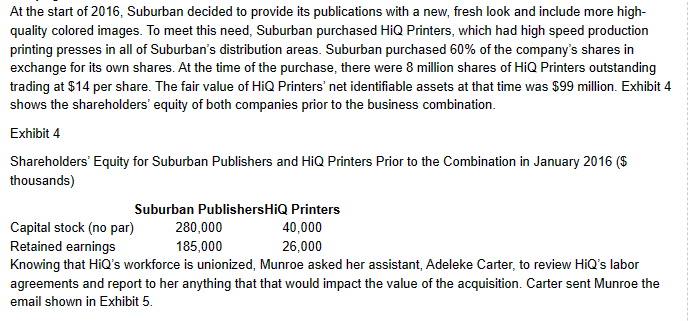

SolutionB is correct. The shareholders’ equity section of the post-acquisition consolidated balance sheet will consist of the capital stock and retained earnings account of the parent and the non-controlling interest of the minority shareholders. Under US GAAP, the value of the non-controlling interest is equal to the non-controlling interest’s proportionate share of the subsidiary’s fair value.

A: Amount paid for 60% interest = 60% × $14/share × 8,000,000 shares = $67,200 thousand

Fair value of subsidiary = 8 million shares × $14/share = $112,000 thousand

B: Non-controlling interest = $112,000 × (1 – 0.60) = $44,800 thousand

A is incorrect. It ignores the non-controlling interest but adds the new shares plus Suburban’s original capital stock plus retained earnings: 347,200 + 185,000= 532,200.

A: Amount paid for 60% interest = 60% × $14/share × 8,000,000 shares = $67,200 thousand

C is incorrect. It uses partial goodwill method to determine the non-controlling interest, which is allowable under IFRS but not under US GAAP.

A: Amount paid for 60% interest = 60% × $14/share × 8,000,000 shares = $67,200 thousand

Fair Value of Subsidiary’s net assets = $99,000 thousand

B: Non-controlling interest of FV of sub’s net assets = 99,000 × (1 – 0.60) = $39,600 thousand

这道题的整体解释都没看明白,望老师能用中文,帮忙梳理一下这个考点的要点