NO.PZ2020021203000073

问题如下:

A seven-month call option pays dividends of USD 0.5 in three months and six months. The strike price is USD 40. Assume a constant risk-free rate of 8% per annum (annually compounded) for all maturities. Is it ever optimal to exercise the option before maturity? Explain.

解释:

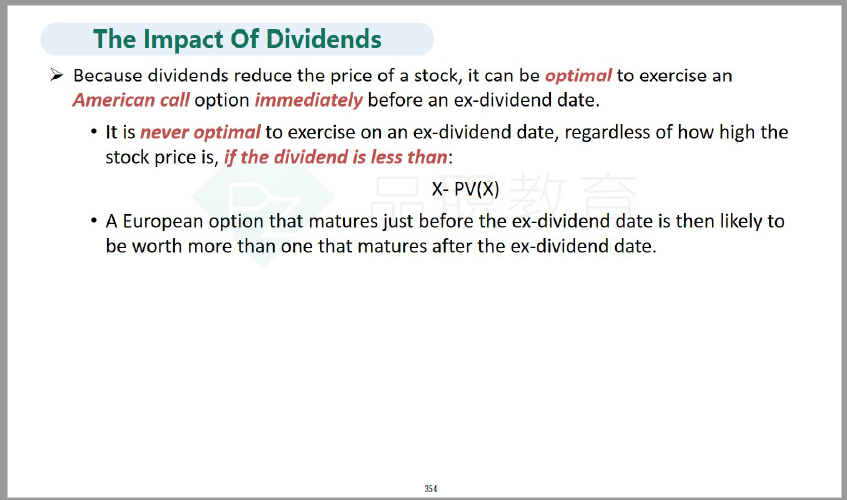

It is only optimal to exercise immediately before a dividend payment. Immediately before the three-month payment, the option holder should wait, because there are three months until the next dividend payment and K - K* is greater than the dividend payment:

Exercise can be optimal immediately before the six-month dividend payment because there is only one month to maturity and K - K* is less than the dividend payment:

请问这是基础课程哪一块的知识点