NO.PZ2016031201000048

问题如下:

An at-the-money American call option on a stock that pays no dividends has three months remaining until expiration. The market value of the option will most likely be:

选项:

A.less than its exercise value.

B.equal to its exercise value.

C.greater than its exercise value.

解释:

C is correct.

Prior to expiration, an American call option will typically have a value in the market that is greater than its exercise value. Although the American option is at-themoney and therefore has an exercise value of zero, the time value of the call option would likely lead to the option having a positive market value.

中文解析:

market value = time value + intrinsic value(即execise value),该option目前是ATM状态,即execise value =0,而距离到期日还有3个月,time value>0,所以market value > 0 , 选C。

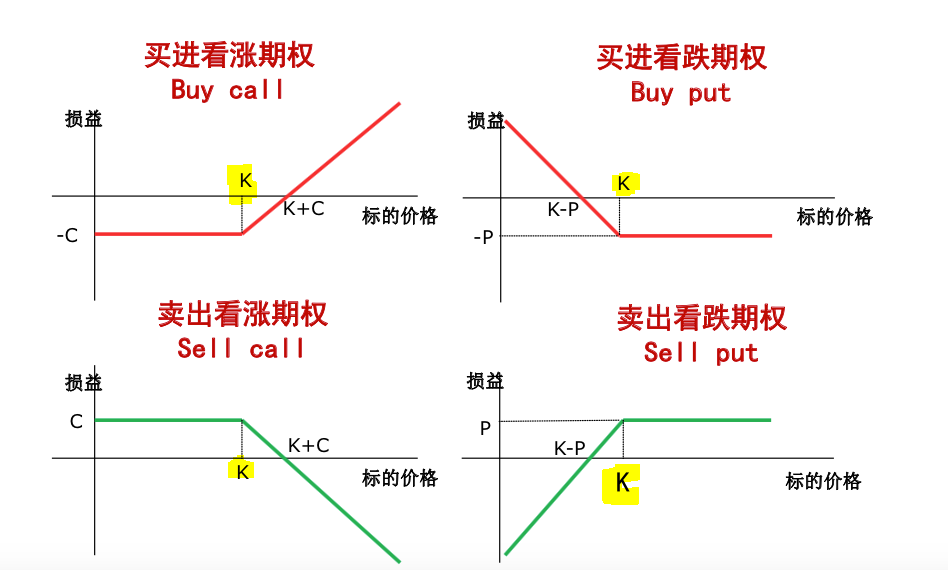

如上