NO.PZ2020021204000037

问题如下:

The Eurodollar futures price for a contract that matures in three years is 95.75. The standard deviation of the change in the short rate in one year is 0.8%. Estimate the continuously compounded forward rate between three and 3.25 years.

解释:

The actual/360 futures rate is 100 - 95.75 = 4.25. This is 4.25 X 365/360 = 4.3090% on an actual/actual basis.

This rate is compounded quarterly. The rate with continuous compounding is 4 X ln(1 + 0.043090/4) = 0.042860

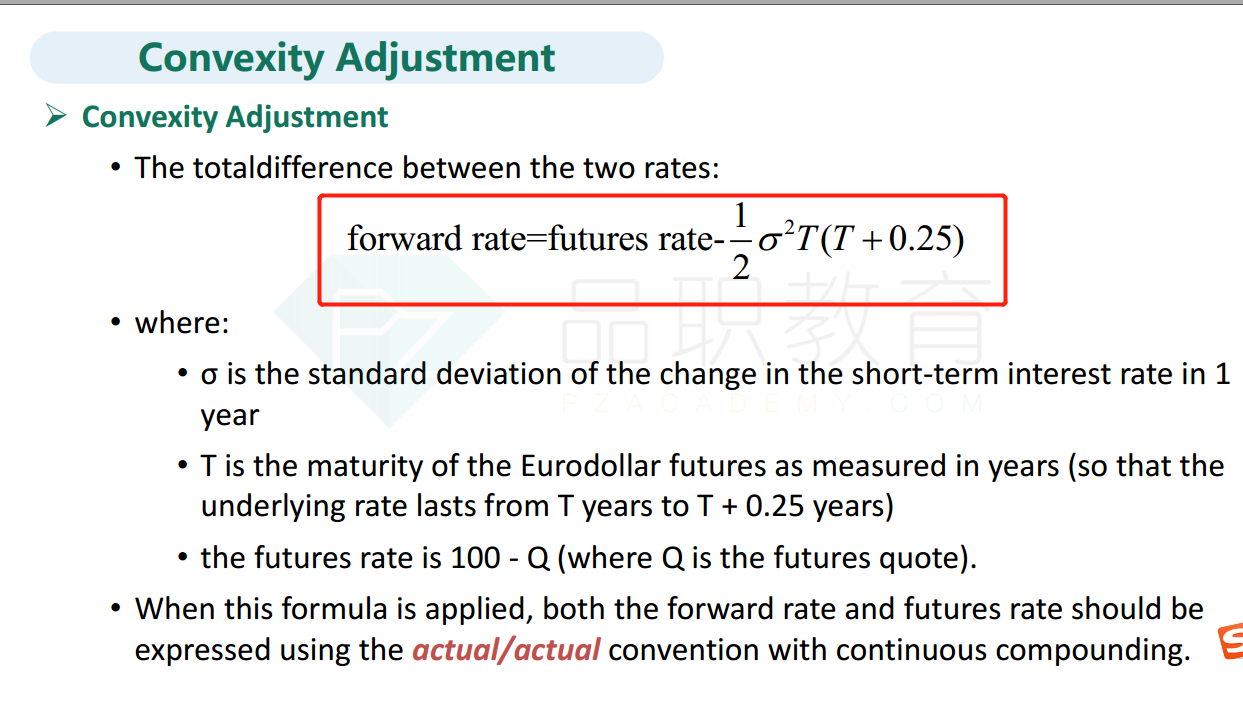

or 4.2860%. The convexity adjustment is 0.5 X 0.0082 X 3 X 3.25 = 0.000312

An estimate of the continuously compounded forward rate is therefore:

0.042860 - 0.000312 = 0.042548 or 4.255%.

这个题是哪个知识点。。。