NO.PZ201710100100000202

问题如下:

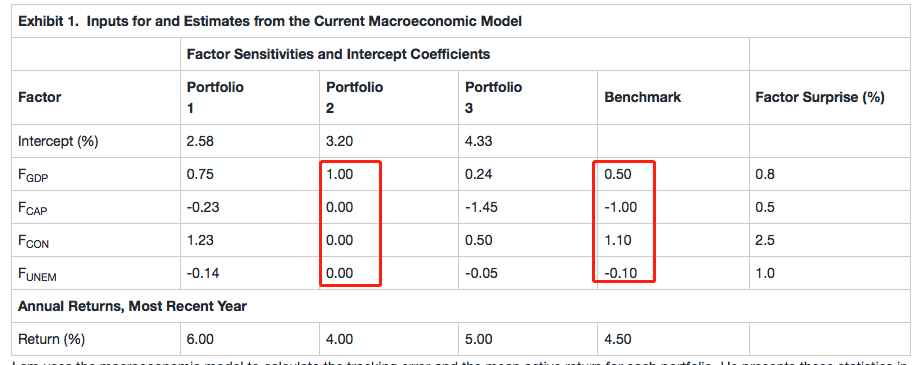

2. Based on Exhibit 1, the active risk for Portfolio 2 is explained by surprises in:

选项:

A.GDP.

B.consumer spending.

C.all four model factors.

解释:

C is correct.

Active risk, also referred to as tracking risk or tracking error, is the sample standard deviation of the time series of active returns, where the active returns consist of the differences between the portfolio return and the benchmark return. Whereas GDP is the only portfolio non-zero sensitivity for Portfolio 2, the contribution to the portfolio’s active return is the sum of the differences between the portfolio’s and the benchmark’s sensitivities multiplied by the factor return. Because all four of the factor sensitivities of Portfolio 2 are different from the factor sensitivities of the benchmark, all four factors contribute to the portfolio’s active return and, therefore, to its active risk.

考点:Multifactor model的应用

解析:题目问的是组合中的active risk可以被哪些surprise解释。

active risk是投资者相对于benchmark所承担的超额风险,所以要找的是这个组合哪些factor sensitivity与benchmark的factor sensitivity不同。

根据表格,benchmark的四个factor sensitivity是0.5,-1, 1.1,-0.1;

而portfolio 2的四个factor sensitivity是1,0,0,0,

四个都不相等,因此组合的超额风险来自于这四个risk factor。

只有有suprise,不管系数是否为0都可以算作是贡献,如果suprise为0,就不能算作是贡献?