Q. To determine the price of an option today, the binomial model requires:

- selling one put and buying one offsetting call.

- buying one unit of the underlying and selling one matching call.

- using the risk-free rate to determine the required number of units of the underlying.

Solution

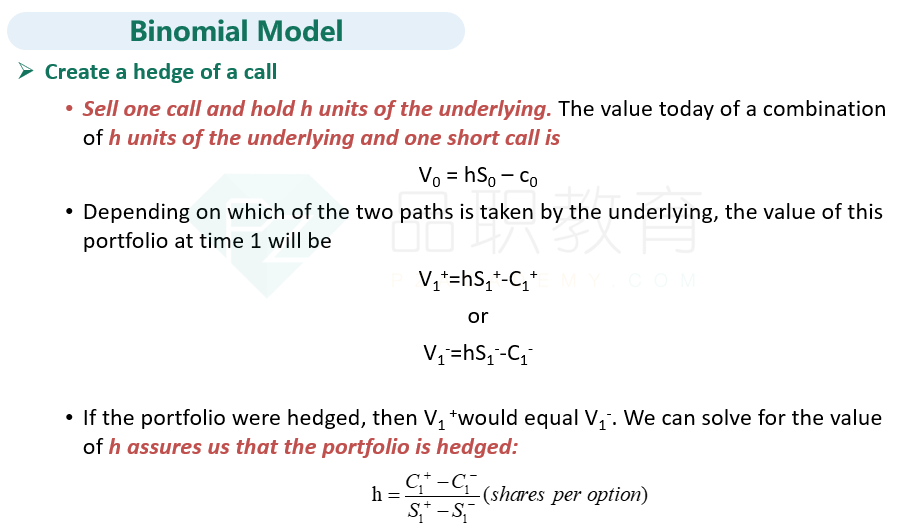

C is correct. Pricing an option relies on the facts that a perfectly hedged investment earns the risk-free rate and that, based on the binomial option pricing model, the size of the two possible changes in the option price (meaning the potential step up or step down in the option value) after one period are equivalent.