NO.PZ2016082404000032

问题如下:

Ms. Zheng is responsible for the options desk in a London bank. She is concerned about the impact of dividends on the options held by the options desk. She asks you to assess which options are the most sensitive to dividend payments. What would be your answer if the value of the options is found by using the Black-Scholes model adjusted for dividends?

选项:

A.

Everything else equal, out-of-the-money call options experience a larger decrease in value than in-the-money call options as expected dividends increase.

B.

The increase in the value of in-the-money put options caused by an increase in expected dividends is always larger than the decrease in value of in-the-money call options.

C.

Keeping the type of option constant, in-the-money options experience the largest absolute change in value and out-of-the-money options the smallest absolute change in value as expected dividends increase.

D.

Keeping the type of option constant, at-the-money options experience the largest absolute change in value and out-of-the-money options the smallest absolute change in value as a result of dividend payment.

解释:

ANSWER: C

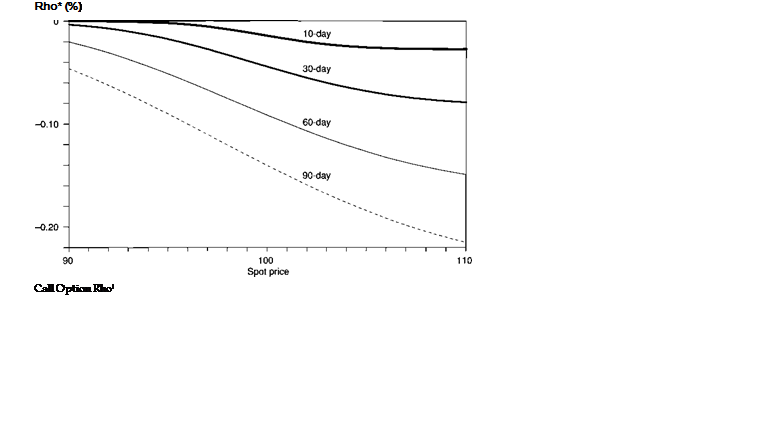

OTM call options are not very sensitive to dividends, as indicated in Figure, so answer A is incorrect. This also shows that ITM options have the highest ρ∗ in absolute value.

应该是哪个字母的考察