NO.PZ201702190300000304

问题如下:

For the Alpha Company option, the positions to take advantage of the arbitrage opportunity are to write the call and:

选项:

A.short shares of Alpha stock and lend.

B.buy shares of Alpha stock and borrow.

C.short shares of Alpha stock and borrow.

解释:

B is correct.

You should sell (write) the overpriced call option and then go long (buy) the replicating portfolio for a call option. The replicating portfolio for a call option is to buy h shares of the stock and borrow the present value of (hS- - c-).

c = hS + PV(-hS- + c-).

h = (c+ - c-)/(S+ - S-) = (6 - 0)/(56 - 46) = 0.60.

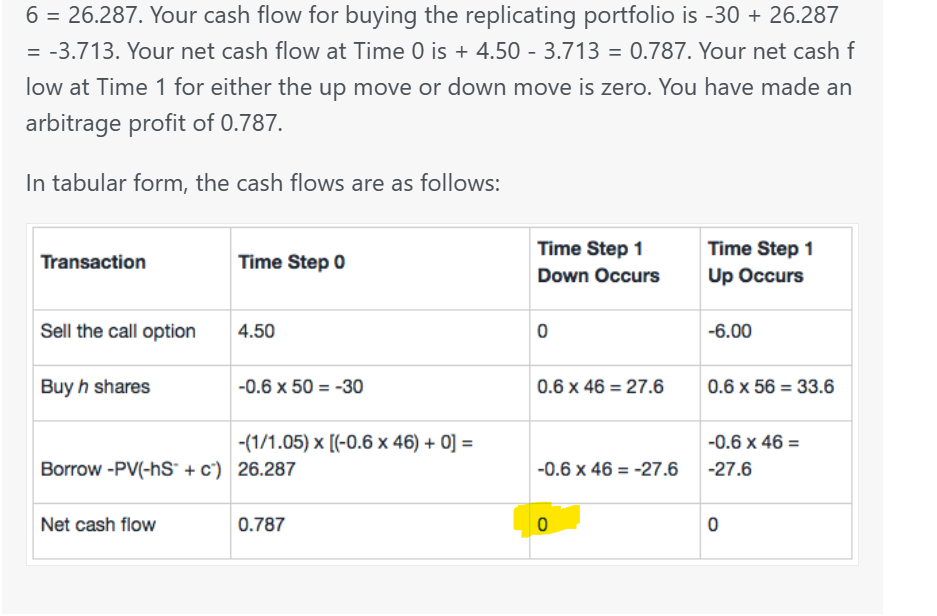

For the example in this case, the value of the call option is 3.714. If the option is overpriced at, say, 4.50, you short the option and have a cash flow at Time 0 of +4.50. You buy the replicating portfolio of 0.60 shares at 50 per share (giving you a cash flow of -30) and borrow (1/1.05) x [(0.60 x 46) - 0] = (1/1.05) x 27.6 = 26.287. Your cash flow for buying the replicating portfolio is -30 + 26.287 = -3.713. Your net cash flow at Time 0 is + 4.50 - 3.713 = 0.787. Your net cash flow at Time 1 for either the up move or down move is zero. You have made an arbitrage profit of 0.787.

In tabular form, the cash flows are as follows:

根据题干信息可知,当前的市场上关于Alpha公司的看涨期权是被高估的,因此套利操作下我们可以卖出被高估的买进被低估的,因此正如本题问题中表述的已经卖出了看涨期权,然后需要的操作是买入一个合成的看涨期权。

看涨期权的合成相当于借钱买股票,因此本题选B。

老师,前面我都看懂了,在t=0时刻卖出被高估的看涨期权,买入合成的看涨期权,arbitrage profit=price-value=0.786,

但是请问Your net cash flow at Time 1 for either the up move or down move is zero. 这句话是什么意思?