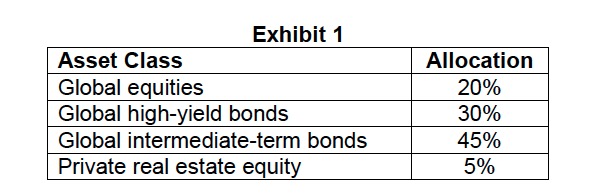

The pension plan sponsor, JWR Industries, is a privately owned capital goods manufacturer with a relatively young workforce. The financially strong company is building a new factory and expects to add employees over the next three years. As a result, company management would like to minimize cash contributions to the Plan. In response, the investment committee decides to reduce its allocation to global intermediate-term bonds from 45% to 30% but is debating what asset class or classes should fill the resulting 15% vacancy in its strategic allocation.

2. The most appropriate recommendation to the investment committee for filling the 15% vacancy in the pension’s strategic asset allocation is to:

A. increase the allocation to global equities.

B. increase the allocation to private real estate.

C. add allocations to hedge fund strategies and private equity.

何老师上课讲过,当雇主减少contributions 时养老金应该保持更多的流动性, 不是应该要投在global equity嘛?