NO.PZ202207040100000405

问题如下:

Lisette Langham Case Scenario

Exhibit 1

Rewarded Factor Results

On viewing Exhibit 1, Shaw makes the following comments about the MFC Value Fund:

The small-cap tilt helped.

Value funds were out of favor, as shown by the Value factor results.

Of course, the MFC Value Fund must have a lower alpha because its performance was 0.03 percentage point worse than its benchmark.

Shaw has particular interest in MFC’s popular Soar Fund (Soar), which relies on returns from factor exposures. The description of the fund states that it emphasizes security-specific factors, maintains low security concentration to keep idiosyncratic risk down, and embraces quality and value styles. Soar occasionally considers the economic and geopolitical environment, especially during unusual economic conditions. Langham tells Shaw how she classifies Soar’s portfolio construction approach.

Noting that MFC has two managers who use the same index as their benchmark, Shaw observes that Fund A and Fund B have similar Active Share and a similar number of positions, but Fund A’s realized active risk of 7% is almost three times greater than that of Fund B. Shaw makes the following comments:

I think Fund B makes a lot of sector bets.

Fund A likely has higher fees than Fund B

Fund A should have a greater dispersion of returns about the benchmark.

Shaw next asks Langham to show how risk targets and constraints might differ between fund managers depending on their respective skills. Langham has Shaw consider three fund managers, each of whom use the MSCI World Index benchmark. For each fund, risk targets have been assigned that allow the portfolio managers some flexibility to exercise their perceived skillsets. Skills include stock picking, factor exposure, and sector rotation. Based on only the data shown in Exhibit 2, Langham identifies the skill applied by each manager.

Exhibit 2:

Risk Targets and Constraints

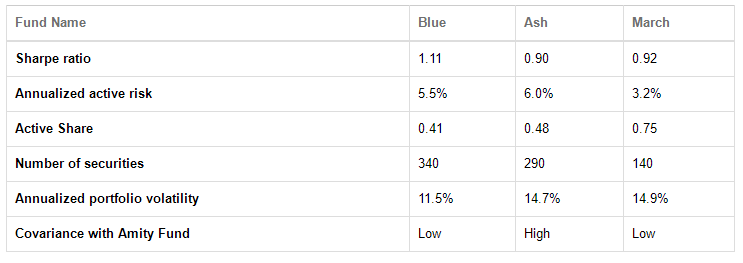

Another of Langham’s clients, Marianne Quint, sits on the investment committee of the Amity Island Endowment. The $2 billion equity portion of the Amity fund is invested using a global equity index approach. Quint has been charged with identifying an active equity fund to replace 20% of the indexed portfolio. Three candidate funds with similar performance histories, benchmarks, and fees have been identified. Based on the characteristics shown in Exhibit 3, Quint asks Langham to recommend the fund that has demonstrated the best risk-efficient delivery of results.

Exhibit 3

Characteristics of Candidates for Amity Equity Portfolio

Langham also identifies the fund that could minimize the active risk of the total $2 billion Amity equity portfolio after replacement is complete.

Question

From Exhibit 3, the replacement candidate fund that, if included, will most likely minimize the active risk of the final Amity equity fund is:

选项:

A. Ash.

B. Blue.

C. March.

解释:

SolutionA is correct. Active risk is a measure of the volatility of portfolio returns relative to the volatility of benchmark returns. The Ash fund will most likely minimize the active risk when combined in the final Amity equity portfolio because of its high covariance with the present fund. The low-covariance funds may reduce overall portfolio volatility but not active risk.

B is incorrect. The low covariance with the Amity portfolio will lower the overall volatility of the fund but not the active risk, because active risk measures the volatility of portfolio returns relative to that of the benchmark: This will be achieved through the substitution of a high-covariance fund.

C is incorrect. The low covariance with the Amity portfolio will lower the overall volatility of the fund but not the active risk, because active risk measures the volatility of portfolio returns relative to that of the benchmark: This will be achieved through the substitution of a high covariance fund.

Active risk的公式算法要求掌握嗎?這題可以從active risk公式的角度分析嗎?