No.PZ2021052007000008 (问答题)

Squaw Valley Fund of Funds (SVFOF) charges a 1% management fee and 10% incentive fee and invests an equal amount of its assets into two individual hedge funds: Pyrenees Fund (PF) and Ural Fund (UF), each charging a 2% management fee and a 20% incentive fee. For simplicity in answering the following questions, please ignore fee compounding and assume that all fees are paid at year-end.

1 If the managers of both PF and UF generate 20% gross annual returns, what is the net-of-fee return for an investor in SVFOF?

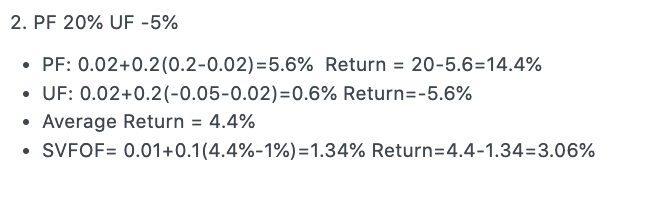

2 If PF’s manager earns a gross return of 20% but UF’s manager loses 5%, what is the net-of-fee return for an investor in SVFOF?

老师你好 这个第二问里是不是等于假设了negative return就不算incentive fee了呢 有的题目里positive和negative都算 所以我下面的答案他-5%return的时候我是算进来的 想问一下考试的时候题目是会说清楚的对吗

谢谢老师!