NO.PZ2016012102000191

问题如下:

LJF firm recognized a $350,000 writedown of inventory values in 20X8, but reversed the $350,000 writedown in 20X9 and increased the inventoy's carrying value. It is least likely that

选项:

A.LJF firm was under the U.S. GAAP.

B.The COGS would decrease by $350,000 in 20X9.

C.The reason of the reversal also need to be disclosed.

解释:

A is correct.

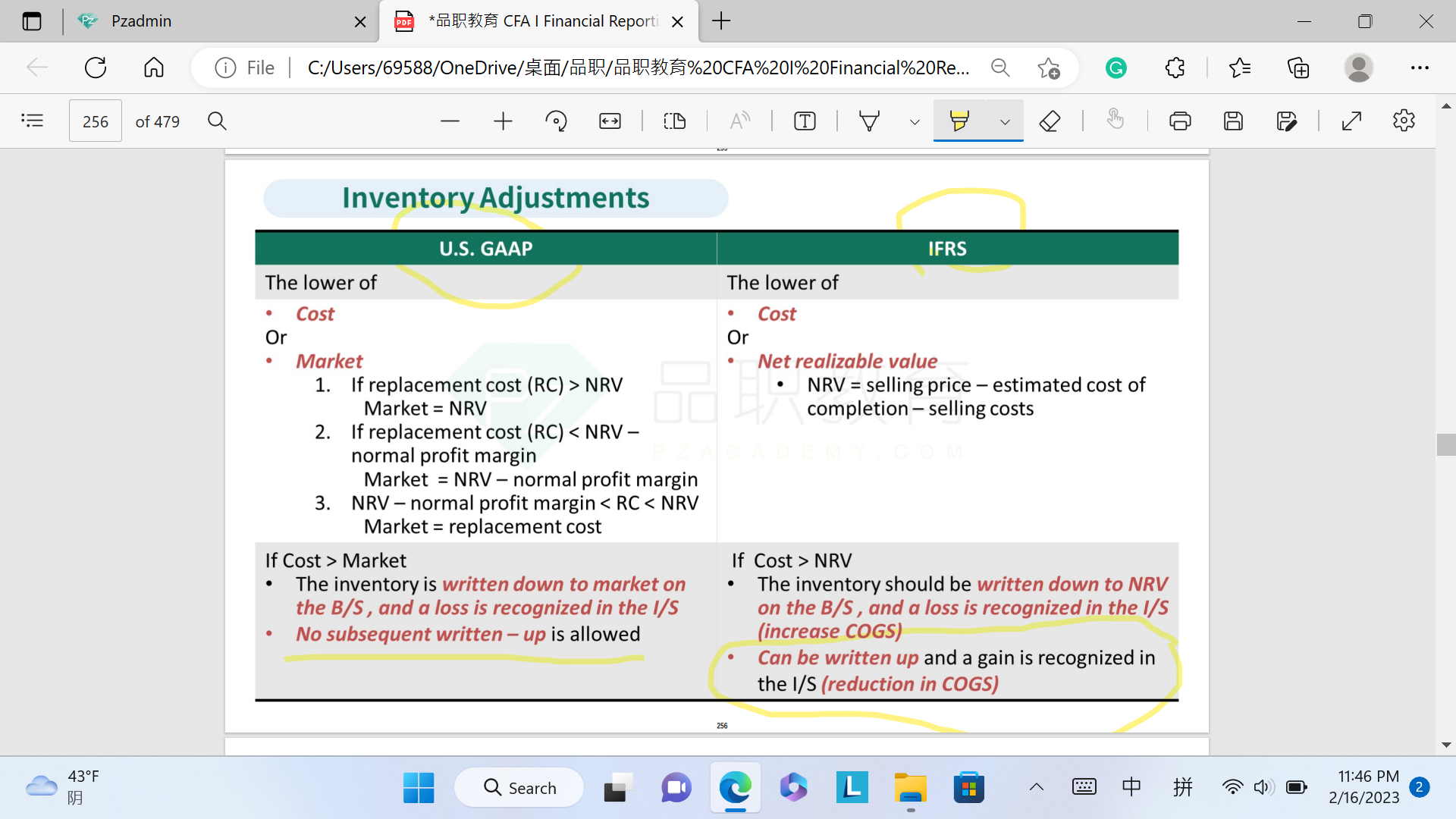

Under the U.S. GAAP, the writedown of inventory cannot be reversed. The inventory reversal under the IFRS can be treated as an decrease of the COGS and the reversal reason should be disclosed in notes.

考点: USGAAP和IFRS的差异

USGAAP下,存货减值(writedown)不能转回(reverse)。

IFRS下,存货减值(writedown)允许转回(reverse),但是存货转回(reverse)的金额,将抵减销售成本,并且需要披露转回的原因。

请问这道题为何会increased the inventoy's carrying value?