NO.PZ202206260100000401

问题如下:

Are Nguyen’s comments to Thompson regarding the results of a potential reallocation from fixed income to real estate most likely correct?选项:

A.Yes, she is correct. B.No, she is incorrect regarding the liquidity. C.No, she is incorrect regarding the diversification benefits.解释:

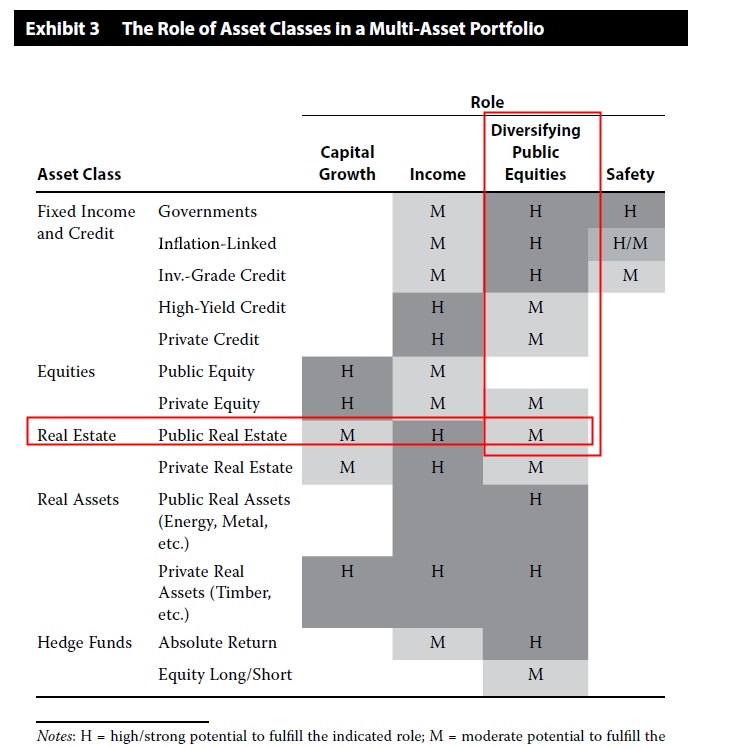

SolutionC is correct. Public real estate has had a fairly high, positive correlation with equities, as well as a high, positive equity beta. In contrast, fixed income has broadly had a negative correlation with equity and a small but negative equity beta. Switching from fixed income to real estate will likely decrease portfolio diversification and increase return volatility.

A is incorrect. Nguyen is incorrect regarding the diversification benefits.

B is incorrect. Public real estate investment is highly liquid.

15years是属于长期了吧,应该和股票的相关性不高啊