NO.PZ2018113001000003

问题如下:

A $100 million pension fund with 80% stock and 20% bond. The beta of equity portion is 1.2 and the duration of bond portion is 5.0. In order to adjust the allocation to 60% stock and 40% bond.

Calculate the number of stock index futures needed to buy.

Based on the following information:

- The stock index value is at 1,200, multiplier is $250, the beta is 0.95

- The price of bond futures contract is $105,300 with an implied modified duration of 6.5.

选项:

A.

-88

B.

-84

C.

-95

解释:

B is correct.

考点:用futures contract 调整组合的头寸

解析:

现需要将股票头寸从80%降至60%,即需要将20%*100,000,000=$20,000,000的股票的beta调整为0(转成cash)

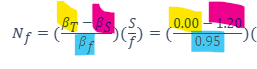

需要的stock index futures contract数量为:

负号代表卖出,即需要卖出84份股票期货合约, 对应的也就是买入(-84)份合约,选B。

(注意,本题中问的是需要的股指期货合约的份数,因此关于债券的信息是用不到的)

在一些具体数据上不知道哪个duration用在谁的BPV上,可以展示一下具体的过程吗?谢谢