NO.PZ2016021705000056

问题如下:

A company with 20 million shares outstanding decides to repurchase 2 million shares at the prevailing market price of €30 per share. At the time of the buyback, the company reports total assets of €850 million and total liabilities of €250 million. As a result of the buyback, that company’s book value per share will most likely:

选项:

A.increase.

B.decrease.

C.remain the same.

解释:

C is correct.

The company’s book value before the buyback is €850 million in assets − €250 million in liabilities = €600 million. Book value per share is €600 million/20 million = €30 per share. The buyback will reduce equity by 2 million shares at the prevailing market price of €30 per share. The book value of equity will be reduced to €600 million − €60 million = €540 million, and the number of shares will be reduced to 18 million; €540 million/18 million = €30 book value per share. If the prevailing market price is equal to the book value per share at the time of the buyback, book value per share is unchanged.

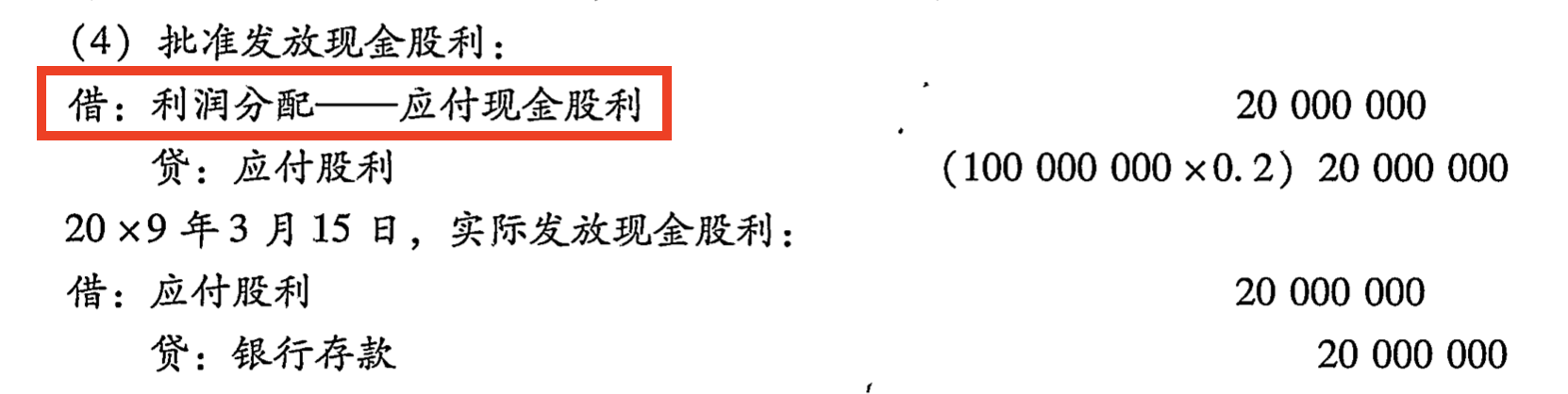

老师,cash dividend,asset里面cash减少了,equity里面哪个科目减少的呢?

另外如果是share dividend,那么asset 和liability不变,只是equity里面的资金从retained earning 进了contributed capital对吗?