NO.PZ2016012102000121

问题如下:

Abbott Corp. is a technological company in USA and follows U.S. GAAP. In year 2013, it spent $5 million on research and $3 million on development of a financial software. Abbott Corp expected to own the software copyright for 20 years and with salvage value of $10,000. What is the book value of the software copyright at the end of 2014?

选项:

A.$0.

B.$399,500.

C.$149,500.

解释:

A is correct.

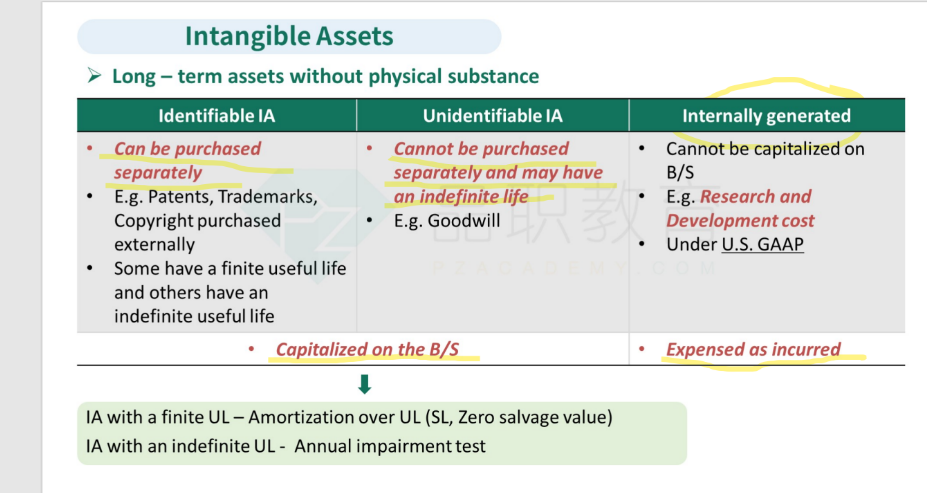

Research and development costs are generally expensed when incurred under U.S. GAAP. The total research and development cost is $8 million and expensed in year 2013. Therefore, its book value in 2014 is 0.

考点:研发费用。

据教材内容,美国准则下R&D一般都是费用化,但是development cost特定情况可以资本化:

1 销售目的:资本化前提是feasibility is established

2 自用目的:资本化的前提是prbable,项目即将完成,软件将按预期使用。

这道题根据题目条件,只说了公司花了R&D在软件开发上面,公司预期这个软件专利能保留20年。题目并没有给出该软件的feasibility is established或者项目完成是prbable的条件,我们只能按照一般化的情形进行处理,也就是费用化。

所以研发费用全部费用化在2013年,金额为$8 m。2014年无形资产的账面价值为0。

所以无形资产都要直接费用化?学到这儿老师不是只讲了有形资产吗,我怎么不记得无形资产是怎么说的了