NO.PZ202207040100000406

问题如下:

Which of Shaw’s comments about the MFC Value Fund in Exhibit 1 is most accurate? The comment concerning:

选项:

A.alpha.

small-cap tilt.

value being out of favor.

解释:

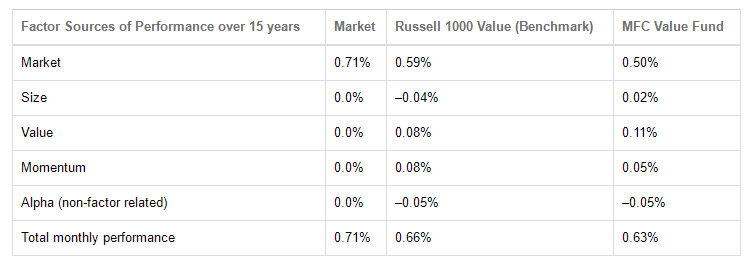

B is correct. Shaw’s comment about a small-cap tilt is correct. Additional exposure to smaller firms resulted in a positive performance of 0.02% for the Size factor.

A is incorrect. Alpha is defined here to include performance unexplained by the factors and matches that of the benchmark.

C is incorrect. Although the value style does appear to be out of favor as shown by the lower return than that of the market (0.66% versus 0.71%), the Value factor has a positive contribution to the return (0.08%).

C is incorrect. Although the value style does appear to be out of favor as shown by the lower return than that of the market (0.66% versus 0.71%), the Value factor has a positive contribution to the return (0.08%).

没怎么特别明白这个的具体意思

谢谢